Live from Probiota 2014

Data eater: EU probiotic yoghurt market to drop 4.5% by 2018; supplements on the up

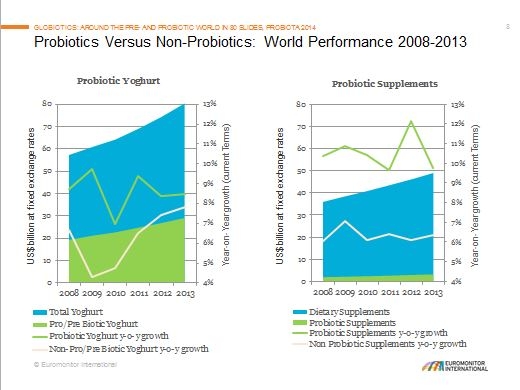

That fall would be matched by a 5% growth in the same 20 EU markets in probiotic food supplements, which were the 6th fastest growing supplements category, said Hudson, Euromonitor’s global head of health & wellness research.

Eastern Europe grew at 12% in 2013. Western Europe would only grow at 2% but Hudson noted, “It looks like Italy is over the worst. We have growth on the horizon and it looks like growth is accelerating.” Italy also had the highest per capita spend at €6, more than double the US at €3.

In the five year period, annual growth of 1-2% was expected in probiotic food supplements at constant prices in the EU markets – greater than other supplements. Globally the market sat at about €2.4bn compared to about €20bn for probiotic foods and drinks.

The impact of the EU nutrition and health claims regulation (NHCR) that has banned the terms ‘probiotics’ and ‘prebiotics’ as marketing terms since December 2012, coupled with the economic recession that had affected most European nations, were cited as the major causes of the yoghurt decline.

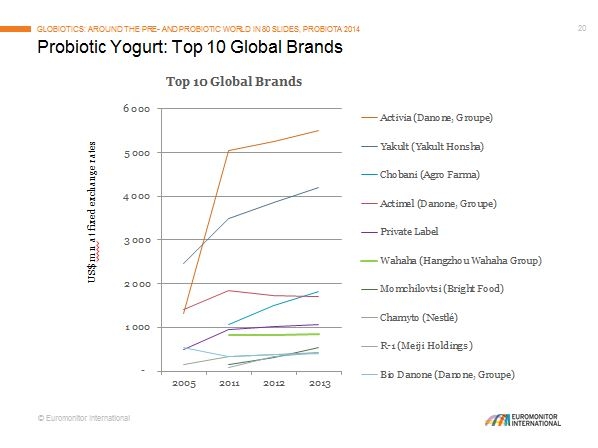

European and global market leader in spoonable probiotic yoghurt, Danone’s Actimel, would see negative growth in Europe, but the brand continues to grow globally, driven by rapid expansion in markets like Brazil and worth about €4bn.

“Overall probiotics still resonate with consumers,” Hudson said, noting probiotics accounted for just over a third of a global yoghurt market worth €60bn.

“Probiotic yoghurt grows faster than regular yoghurt every year we have measured.”

Supplements

In supplements the US was the standout market in growth and volume, with pre- and probiotics registering 18% growth to become the second biggest supplements category there. Australia saw a similar situation and Russia also posted strong growth.

The Middle East rose 20% and probiotics were the number one selling category, albeit from a much smaller base.

In the Asia Pacific, pre- and probitoics were only ranked 18th and registered only 1.5% growth.

Canada was singled out as a growth market at 19% in 2013 with Align and Hylak probiotic supplements from Procter & Gamble driving the way.

Asked about new formats Hudson said RTD green tea had a lot of potential for probiotic blending, especially if weight control indications were reinforced.