Dairy in sales decline as Danone tops global dairy rankings again

Yet much of this decline is to do with currency exchange as several major currencies weakened against the US dollar, including the Euro, pound, rouble, real and CNY since 2015.

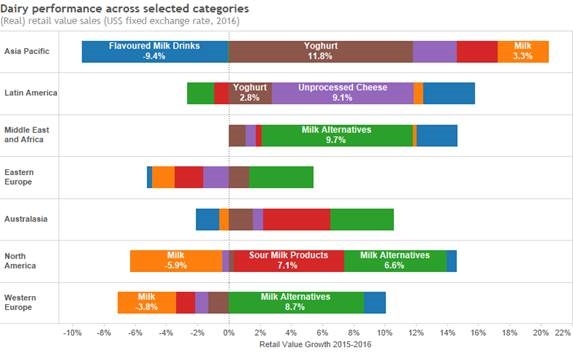

Whilst the effects of unfavorable exchange rates should not be underestimated, at least consumers are not buying less of what they eat. On the contrary, between 2015 and 2016, according to Euromonitor, retail volume of overall dairy is growing and fixing exchange rates against the dollar paints a different picture with global retail sales growth of 4% in 2016.

This in fact is in line with overall snacks’ performance, a category once thought of as the biggest growth driver of packaged food. Consumers at last recognizing dairy foods as nutritious and natural snacks is benefiting the dairy industry. As a result, many traditional snack companies are now looking to gain a foothold in dairy as a new growth generator within the health arena.

The Euromonitor figures show that retail value for the global dairy market rose steadily from $474.4bn in 2011 to $501.6bn in 2014, before dropping to $454.2bn in 2015 and $452.6bn in 2016.

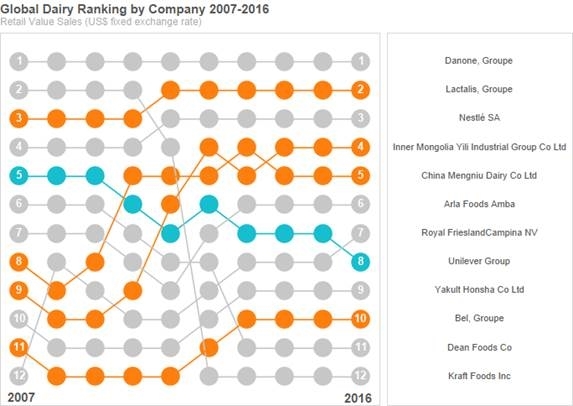

The data also shows the global dairy rankings for 2007-2016 (in retail value sales, in US$ fixed exchange rate), with Group Danone maintaining its number 1 spot.

The only change in the top 12 rankings from 2015 sees Royal FrieslandCampina rise one place to seventh, while Unilever Group drops one to eighth.

Euromonitor: Global dairy rankings by company 2016 in retail value sales (US$ fixed exchange rate)

- Group Danone

- Groupe Lactalis

- Nestlé SA

- Inner Mongolia Yili Industrial Group Co Ltd

- China Mengniu Dairy Co Ltd

- Arla Foods amba

- Royal FrieslandCampina

- Unilever Group

- Yakult Honsha Co Ltd

- Groupe Bel

- Dean Foods Co

- Kraft Foods Inc

Lianne van den Bos, Euromonitor senior food analyst, told DairyReporter that companies were reacting to the statistics.

“Strategies are threefold,” she said.

“One strategy of Nestlé for example is focused on reformulating its confectionery range by making them additive free or without artificial colors and flavors.

“It has also appointed a new CEO with strong background in pharma and therefore bringing in fresh eyes to transform the company towards health and nutrition.”

She added that another strategy is through acquisition, such as Danone’s takeover of WhiteWave.

“Last, Big Food companies have also been investing in start-ups. Over the last few years, hundreds of start-ups have raised substantial money in funding from traditional venture capital investors and Big Food makers, challenging legacy brands.”

Dairy alternatives and milk can both thrive

There is room for dairy alternatives and milk products, and both can do well, van den Bos noted.

“The dairy industry, predictably, has been up in arms about this shift away from dairy to alternatives and proactively advocated about milk’s excellent health benefits, and it is starting to pay off,” she said.

“Our data shows that both milk alternatives as well as dairy products can perform well in 2016 and not necessarily take share from one another. That in turn suggests that consumers can be swayed either way and it’s the health proposition that sells.

“Snack companies such as Mondelēz may currently think of their biggest rivals as Mars or PepsiCo but the reality is that as the blurring of categories continues and the very definition of ‘snacks’ changes,” she added.

“Danone’s acquisition of WhiteWave is a clear sign of the direction of growth towards nutritious foods and dairy alternatives.”

Impact of move to snacking

And van den Bos told DairyReporter that the trend toward snacking is changing the food landscape.

“Over time, busier consumers’ lifestyles, the changing role of women in the household and other cultural factors have led to consumers shifting away from sit-down meals at home towards irregular snack consumption out of the home,” she said.

“The rise of snacking has not only led to the development of the conventional snacks industry, but is now starting to change how non-conventional snacks such as yogurt, drinking milk products and cheese are sold to consumers, creating a new field of competition for snack brands.”

She added that dairy products are viewed as naturally nutritious, and have become an obvious option for brands looking to build a healthy, or healthier snack line extension.