US COMMODITIES CORNER

'Escalating' US cheese prices push Class III milk prices to year high

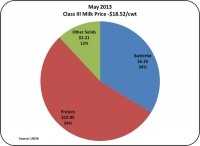

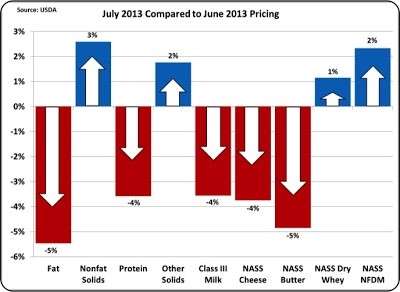

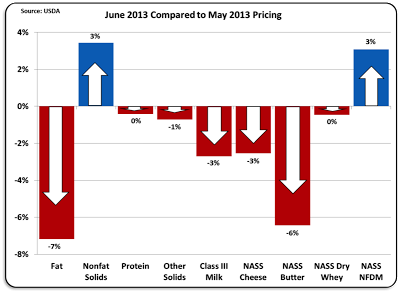

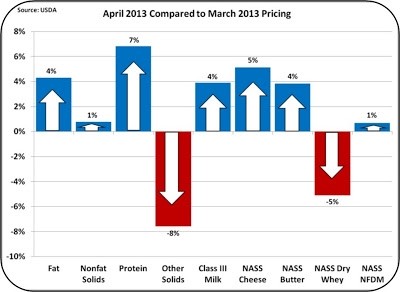

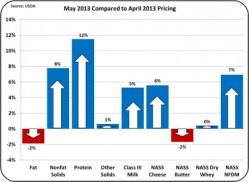

The Class III milk price was $18.52 per hundredweight (cwt), the highest price for 2013. The higher May milk price was driven by escalating cheese prices.

Inventories of cheese, butter, and whey are all high, which creates concern about downward pricing pressure. Continued high inventories will force price declines if the inventories are not reduced.

May's component prices fall in line with the long term trends. Protein at $3.36 per pound (lb) shows the importance of protein for the economical production of the growing cheese and yogurt sectors. Butterfat declined slightly and may continue its retreat consistent with consumer consumption changes.

Other solids were up after a few months of declines, solidifying its increased importance in contributing to the milk check.

The production of whey is dependent on cheese production; and therefore, demand can outstrip production. No one manufactures whey by itself. The price of other solids is based on the price of dry whey.

The breakdown of the milk payment pie chart shows that 54% of the milk check is now attributable to milk protein payment. Butterfat's contribution declined to 34% of the milk payment.

Changing consumer consumption

Consumer consumption of butter declined, beginning around 1940, when butter substitutes were developed.

Initially the quality of these substitutes was very poor, but overtime, the quality and marketing of these 'spreads' improved to where they were accepted by the majority of consumers as substitutes for real butter. Per capita consumption of butter bottomed out around 1970 and has remained flat since then.

Consumption today is roughly 1/3 of what it was before 1940.

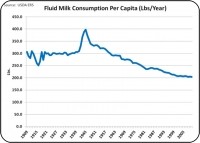

Milk has seen a similar decline in consumption trends. Milk consumption increased early in the twentieth century, peaking in the late 1940s.

Since then, competing beverages have taken significant sales from milk. This trend is continuing with no end in sight.

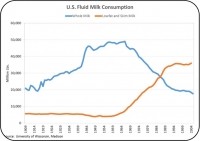

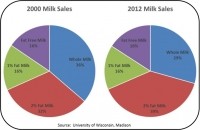

There is also a significant change in the type of milk consumed.

An interest in low fat milk started In the 1960s. It started a trend that continues to this day. Reduced fat milk now significantly outsells whole milk.

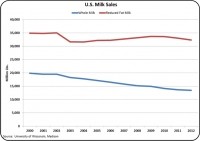

Since 2000, the sales of reduced fat milk have remained fairly constant.

The decline in milk consumption has come from whole milk.

Comparing the trends since 2000, the clear winner is 2% fat milk.

By 2012, 39% of the milk consumed was 2% fat and whole milk has fallen to just 29%. No fat milk and 1% fat milk have both remained steady at about 16% of total milk.

The conclusions from this data are obvious. The demand for butterfat is falling. Only about 5% of butter is exported.

The demand for cheese and yogurt continue to grow. Similarly, there is an increasing consumer interest in reduced fat and no fat products in these categories.

In May, US butterfat was valued at over $1.78 per lb. It is difficult to see any long term improvement in this price.

The need for protein to comply with the casein protein to fat ratio for economical cheese production, and the need for protein as a thickener for yogurt manufacture, will put additional pressure and rewards on dairy producers to increase protein levels.

One of the most recognized ways of doing this is by balancing amino acids in dairy cow diets.

Dairy producers will become dependent, primarily on protein for revenue.

The trends are clear, and to be successful, producers will have to adapt to these trends.

US-based John Geuss is the editor of US dairy commodities blog, MilkPrice.

For more of John's in-depth month-to-month dairy commodity price updates, click here.