Saputo trumps Murray Goulburn with $425m Warrnambool offer

Quebec-based Saputo, which boasts operations in Canada, the US, and Argentina, announced yesterday that it had increased its all-cash 100% takeover offer for WCB to AU$8.00 (US$7.70) per share.

The offer tops Murray Goulburn’s 18 October cash per share offer of AU$7.50 (US$7.20).

WCB’s board of directors has, for the second time this month, given its backing to a takeover by Saputo, after it universally recommended that its shareholders accept Saputo’s initial cash offer of AU$7.00 (US$6.72) per share on 7 October.

“After consideration of the revised Saputo offer and offer announced by Murray Goulburn on 18 October, the WCB Board unanimously recommends WCB shareholders accept the revised Saputo Offer, in the absence of a superior proposal,” said a statement issued by WCB earlier today.

WCB “takes comfort” in assurances

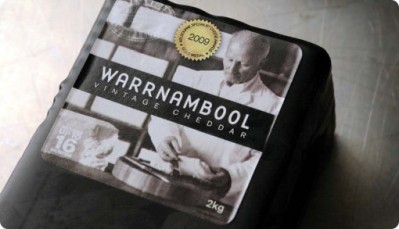

WCB manufactures a wide range of dairy products for domestic and export markets, including fresh milk, cheese, butter, milk powder, and whey protein concentrate.

It currently employs more than 420 people across its sites in Allansford, Mount Gambier and Port Melbourne.

According to WCB chairman, Terry Richardson, assurances given by Saputo about the security of these existing positions played a large role in the board’s decision to recommend the revised offer.

“The Board carefully considered both the Murray Goulburn proposal and Saputo’s revised offer before coming to its decision to recommend the revised Saputo offer in the absence of a superior proposal,” said Richardson.

“In addition to the attractive price offered to shareholders, the WCB board takes comfort in Saputo’s assurance to suppliers and employees, as well as its intentions to invest in WCB’s assets and pay a leading competitive milk price,”

Saputo takeover not “in the national interest”

Responding to news of Saputo’s improved per share offer, Murray Goulburn reiterated its commitment to acquiring WCB, which it currently owns a 17.7% stake in.

“MG believes that resolution of the future ownership of WCB will be a long process and that WCB shareholders should not act prematurely in relation to giving up control of their shareholdings,” said a statement issued by Murray Goulburn.

“MG remains committed to acquiring WCB and to satisfying all conditions associated with its offer as quickly as possible.”

“MG believes it to be reasonable and in the national interest that Saputo’s Foreign Investment Review Board (FIRB) application to acquire WCB is not resolved until the public benefits of MG’s proposed acquisition of WCB have been given fill consideration – pursuant to MG’s application for authorisation to the Australian Competition Tribunal to acquire WCB,” it added.