US COMMODITIES CORNER

Is 'anticipation of reduced demand' for cheese behind Class III milk price fall?

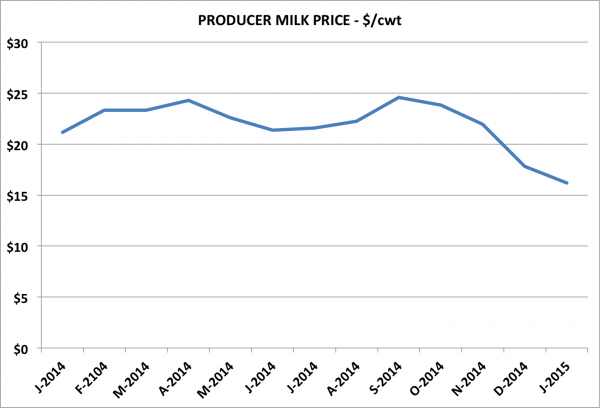

After a very strong year in 2014, US producer milk prices are falling quickly.

The Class III milk price, the price at which the majority of producers are initially paid, was $16.18 per hundredweight (cwt), down from a high of $24.60 per cwt in September 2014.

This represents a 34% drop in the price that dairy producers are paid for their milk.

For a more detailed explanation of the US milk payment system, click here.

Because feed and operating costs have not changed significantly during this time, the drop in milk prices represents a very significant decrease in margins for US dairy producers.

What’s behind the drop in prices?

The price of Class III milk is driven primarily by the wholesale price of cheese as measured by National Agricultural Statistics Service (NASS).

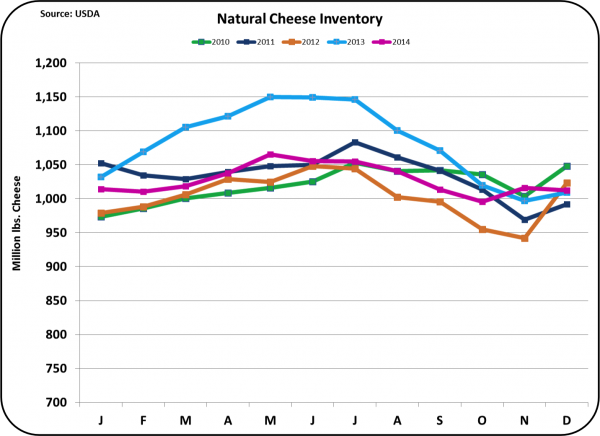

Supply and demand for cheese and the resulting inventory levels strongly influence the price of cheese.

Higher inventory levels result in lower prices, as there is more for sale than there is demand for cheese. Low inventory levels typically bring high prices.

However, as shown in the chart below, the 2014 year-end cheese inventories are in line with historical levels.

The data do not show high inventories, which typically force a lower price.

What seems to be driving the price decline is the anticipation of reduced demand resulting in high inventories and, therefore the possibility of lower future prices.

The decrease in demand is driven by the fear of declining exports.

Although only about 7% of US cheese is exported, the strength of the US Dollar versus the Euro and other currencies has made sales of US cheese in the international market more difficult.

A 10% decrease in the US$/Euro ratio makes European cheeses 10% less expensive compared to US cheese.

Also, the Russian embargo of European dairy products has made more European cheese available in the international markets.

The largest importer of US cheese is Mexico, with South Korea and Japan representing the second and third largest export markets for US produced cheese.

While there has been some softening of cheese exports toward the end of year, 2014 was still a record for US cheese exports and positions the US as the world’s leading cheese exporter for 2014.

Most of the cheese exported is branded cheese, which makes switching brands difficult.

The lower price for cheese and producer milk has been forecast in the Chicago Mercantile Exchange (CME) dairy futures for the last two months.

The hedgers and speculators in this market are expecting a significant decrease in the volume and value of US cheese exports. How this will play out will be seen in the coming months.

John Geuss (left) is the editor of US dairy commodities blog, MilkPrice.

For a detailed month-by-month analysis of American dairy commodity movements, click here.