EMB says milk production costs ‘a crisis’

According to the EMB, current figures on German milk production costs recently published by BAL (German Office for Agriculture and Agricultural Sociology) show there is an acute crisis in the milk market.

In October 2015, the costs of producing one kilo of milk averaged $0.48 (€0.44). At the same time, the farm-gate price of milk in Germany was only $0.32 (€0.29).

The cost study published by BAL in conjunction with the MEG Milch Board and the EMB shows average production costs both throughout Germany and broken down into the East, North and South Germany regions. The costs in all three regions were slightly down on the previous quarter.

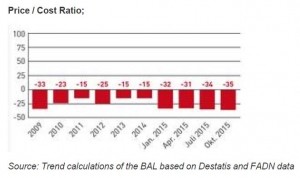

Price/cost ratio drops

The October figure for the price/cost ratio, which measures production cost compared to the milk price, is 0.65. That is, 65% of costs are covered by the farm-gate price of milk.

The EMB says that under these conditions, it is increasingly difficult for farms to carry out repairs or make urgently needed replacement investments, and that wages cannot be sufficiently generated.

Silvia Däberitz, director of EMB, told DairyReporter that production costs in other countries are similar.

“In Belgium the costs are around 46 cents per kilogram of milk - while prices are around 25 cents. In the Netherlands, around 45 cents per kilogram of milk, while prices are between 27.5 and 29 cents, and in Denmark, the costs are around 39 cents a kilogram, while prices are around 29.2 cents,” Däberitz said.

In Lithuania, the price of milk was just $0.22 (€0.20) at the end of 2015, with some producers receiving only $0.11 (€0.10) a kilo.

EMB says price won’t improve

As the trend in the volume of milk on the market exceeding demand has also continued since October, in the medium term and most probably in the long term, too, the EMB believes that milk prices will not recover.

Romuald Schaber, president of the EMB, sees no chance of any improvement because of the current EU milk policy.

"The deficit situation will continue, with the only increases being in debts and the number of farms closing, but not in urgently needed investments in the farms," Schaber said.

Bonuses for less milk

The EMB statement says that many European milk producers aim to cut the volume being produced. However, it states that because in critical price situations individual producers tend to be forced to produce more in order to reduce unit costs, what is required is an EU framework applicable to all dairy farmers.

Such a general provision, according to the EMB, could be based on a voluntary restraint on supply, linked to positive incentives. Interested dairy farmers across the EU would be paid a bonus for cutting production, reducing the pressure of volumes in the market.

Friesland Campina – one of the biggest dairies in Europe – is implementing a bonus system to reduce volumes.

Payments from mixed fund

The MRP document states that it would fund farmers through a mix of a state crisis fund, penalties for farmers increasing their volumes and a producer levy as and when required, limited to the year of the crisis.

When asked how cutting production could be implemented and coordinated across different EU countries, Däberitz told DR, “First there would be a call for tenders regarding voluntary production cuts by the European Commission/the observatory.

“These calls are going out to all EU countries. Every farmer that is interested to produce less (and get a bonus for that) can participate. First it would be farmers from countries/regions with the lowest milk price (since for them it would be mostly attractive).

“If the situation is very unstable, so that a voluntary production cut cannot be enough - then the next step - an obligatory production cut for all farmers would apply. Only 1- 2% per farm volume would have to be reduced.”

Däberitz said that this would apply to all EU farmers, regardless of which country or region they are in.

MRP document outlines strategy

The EMB’s MRP has been drawn up for the dairy sector, which includes a voluntary restraint on supply in response to a crisis. The EMB is calling on EU politicians to apply this concept and at last introduce a process for stabilizing the milk market.

The MRP states that a crisis is defined with the help of a market index, taking into account milk prices and production costs. If this price to production index drops below 100 (i.e. production costs exceed the price of milk), then the MRP would be activated.

According to the MRP, a 7.5% reduction would trigger incentives to increase sales and consumption, and a fall of more than 15% would signify a crisis.

Upward trend triggers end of crisis

This would create a restriction on supply, either voluntary or mandatory, including bonuses for reducing production. A reference period would also be defined.

At 25%, this production cutback would become mandatory for a to-be-determined period.

The EMB says that using this MRP would prevent a collapse of prices due to over-production.

With respect to recovery, if the index trend continues towards 100 points and forecasts for further market development are positive, the crisis can be declared over. On this date all measures restricting production end.

EMB explains timeline

DR asked how quickly the MRP would come into effect, and how quickly would it assist farmers. Däberitz replied that, “If it was implemented right now, the volume would start to be reduced instead of being increased (as is the case now). Within a few months, the situation would already be improved.

“In general, one could imagine crisis periods of three to six months, where the MRP could be used (first with voluntary cuts, which would already in many cases stabilize the market. In very deep crisis the obligatory production cut would ensure the market getting back to a stable level).

“We have seen in the past that only a small volume needs to be reduced so the price would significantly go up. That is why a small percentage in volume change would already be enough,” she added.

Lower prices currently force farmers to produce more, she said. “With the MRP installed low prices would signal to start the bonus system, motivating farmers to produce less (and still letting them survive). Lower prices would therefore trigger the correct reaction - a production decrease.”

NFU opposes MRP

Not everyone, however, agrees that the MRP is the way forward for the industry as a response to prices falling below costs.

Sian Davies, the National Farmers Union (NFU) chief dairy advisor in the UK, said in November 2015 that “UK and EU dairy farmers now compete in a global milk market and no EU only mechanism can manage to cushion EU farmers through periods of market downturn.

“If EU farmers are forced to cut back production this only leaves the gates open for further imports from outside the EU and allows those farmers to be better prepared for increasing production when the market improves.”

Events cannot be predicted

Davies told DairyReporter that “that these views haven't changed and Copa don't support the MRP either. The market needs to now manage volumes not EU policy.”

Davies said that she would support better monitoring of the dairy market and has been calling for improved data collection and forecasting both at UK and EU level to enable farmers to better predict and react to the market.

She points to the Russian embargo as being something that could not have been predicted.

Davies also questioned how the MRP scheme would work with the different milk contracts in the UK, as some farmers are contracted to supply a volume, others are contracted to supply retailers and others have contracts that state “all milk produced will be collected.”