US COMMODITIES CORNER

January prices decline as exports weaken, inventories grow

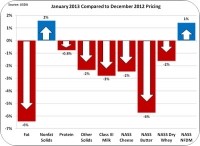

On January 30, the January 2013 Class and Component Prices were announced.

The Class III milk price for January is $18.14 per hundredweight (cwt), down $0.52 or 3% from the prior month.

There is currently some weakening in exports which is causing cheese and butter inventories to grow and prices to decline as supply outweighs demand. Fortunately, exchange rates are increasingly favorable for exports, so the downward trend in exports should be reversed soon.

Changes in component payments were small. The most important parameter impacting milk prices is the NASS price for cheese which fell 2%. Because NASS butter prices fell by 4%, the impact on the value of milk protein was less than 1%.

The value of 'other solids' remains high.

The price for dry whey which is used to calculate the price of 'other solids' was $0.65 per pound (lb), down one cent from the prior month.

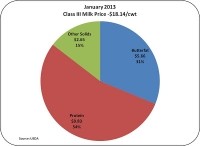

Payment for milk protein continues to dominate milk payments.

Based on Class III pricing formulas, payment for protein made up 54% of the milk check. 'Other solids' continue to be important as the value of whey continues at record highs.

Other solids

'Other Solids' are the smallest contributor to the milk check, but they have become a very positive game changer.

If we look back just five years, 'other solids' were worthless. In 2008 and early 2009, they ranged in value from a high of $0.20 per lb to a low of -$0.30 per lb. Yes, that is a minus sign on the low number, meaning it cost more to dry and sell whey than it could be sold for.

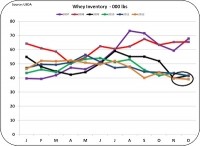

On average in 2012, dry whey sold for $0.59 per lb and in January 2013 it was valued at $0.65 per lb.

Inventories of dry whey remain at record low levels. Demand continues to be strong and the supply is limited to the availability from cheese manufacturing.

There is little reason to expect these prices to fall to prior levels and there is a reasonable expectation of higher prices as the market for dry whey continues to develop.

For part two of John's monthly commodities update, and a pricing forecast for the remainder of Q1 2013, visit www.dairyreporter.com on Thursday 7 February 2013.

You can also see John's month-to-month dairy commodities breakdown at his blog, MilkPrice.