The dairy cooperative announced yesterday it has established joint ventures with Nigerian company, Tolaram Group, and Senegalese firm, Attieh Group.

TG Arla Dairy Products LFTZ Enterprise and Arla Senegal will respectively handle the packaging, marketing, sales and distribution of Arla dairy products in Nigeria and Senegal.

"With the improved living standards, families are increasingly demanding safe and affordable nutrition. West Africa faces a milk deficit, which gives Arla an opportunity to provide milk and other dairy products that meet the consumers' needs," said Steen Hadsbjerg, head of Arla's Sub Saharan Africa business.

"We are here to build a long-term business, and that requires strong local partners. We are therefore pleased to join with two experienced partners in Senegal and Nigeria."

Milk powder

Arla's growth efforts in Sub Saharan Africa began in August 2013 when it established a joint venture with Ivorian distributor, Mata Holdings.

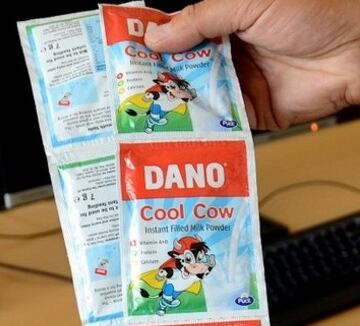

Arla currently boasts sales of €90m in the Sub Saharan Africa, but hopes to hit €460m by 2020 through the sale of liquid milk, Dano brand powdered milk, and eventually cheese and butter.

Nigeria, where Arla holds various distribution deals, accounts for €80m of the current total. Through the establishment of its 50/50 JV with Tolaram, Arla expects its Nigerian revenue to increase to €240m by 2020.

"Nigeria is one of the biggest markets for dairy products in Africa," said Hadsbjerg. "For Arla to succeed in Africa we must succeed in Nigeria."

"The population is growing at a rate of two to three percent per year, and people are young, ambitious and increasingly well educated. This makes Nigeria a perfect market for Arla's Africa strategy, and we expect the new joint venture to start up its sales in the market in September,” he added.

Operations at Arla Senegal, in which Arla holds a 75% interest, are scheduled to begin before the end of the year.

Arla expects revenue from Senegal to reach €32m by 2020.

Revenue down

Accelerating growth outside core European markets is an important part of Arla's current strategy.

The cooperative, which is owned by 12,700 dairy farmers across Denmark, Sweden, the UK, Germany, Belgium, Luxembourg and the Netherlands, yesterday reported revenue of €5.13bn for the first six months of 2015 - down 3.8% on the €5.33bn it recorded in H1 2014.

Performance price, which indicates the value generated from each kilogram of milk supplied, also fell - from 41.7 cents per kilogram of milk in H1 2014 to 33.8 cents.

Arla insists, however, that its H1 revenue is in line with its forecast of between €10.2bn and €10.3bn.

"We have mitigated the impact of the negative market by directing the increasing milk volumes into retail and branded products, consequently limiting the amount going into less profitable commodity products," said Peder Tuborgh, CEO, Arla Foods.

"We are doing everything we can to minimise the effects of the general global market situation, however it cannot change the fact that our farmer owners are in a tough situation right now," Tuborgh added.