Earlier today, in a series of tweets, Kelvin Wickham, managing director of global ingredients, Fonterra, said suspending GDT would not "solve the supply demand imbalance."

GDT, established in 2008 by New Zealand dairy giant Fonterra, is an auction platform for internationally traded commodity dairy products, including anhydrous milk fat, butter, cheddar, lactose, skimmed milk powder (SMP), sweet whey powder, and whole milk powder (WMP).

Amul (India), Arla Foods (Denmark), Arla Foods Ingredients (Denmark), DairyAmerica (USA), Euroserum (France), Fonterra (New Zealand), Land O'Lakes (USA) and Murray Goulburn (Australia) currently sell on the platform.

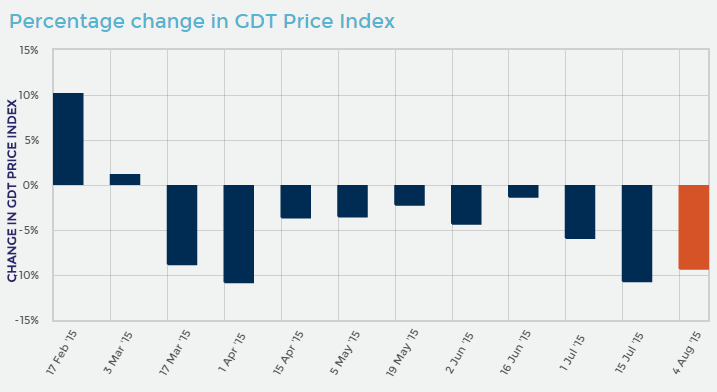

The GDT Price Index - a weighted average of the percentage changes in prices - fell 9.3% after yesterday's bi-monthly auction - the tenth consecutive decrease.

In response, Chris Lewis, president, Waikato Federated Farmers, called for industry-wide discussion on whether GDT should be temporarily suspended until the market improves.

In a series of tweets from @Fonterra, Wickham said: "No one likes low prices but important to remember GDT has not caused low prices - they're a reflection of what's happening in the market."

"There is a supply/demand imbalance - and that's what you're seeing on GDT."

"We're doing everything to move powder and other commodity products into higher value contracts and higher margin products."

"And to those calling for GDT to be suspended, that's not going to solve the supply/demand imbalance," he added.