The European probiotic foods and supplements will shrink €130m in the next five years from €5.13bn last year to about €5bn in 2017, says market analyst Euromonitor’s health and wellness director Ewa Hudson ahead of a presentation at Probiotech and Microbiota 2013 in Brussels next week.

“It’s only a 2.5% drop but we were shocked when these figures came in, by how bad things had become in the EU,” Hudson said.

“But we were shocked because it is so different to what we have seen before. The figures are balanced out by other regions, particularly Asia, but things may not get better in the EU for some time – unless something significant changes like a sharp economic recovery or a probiotic actually wins a health claim.”

The figures are for 20 EU countries (out of 27) and are at 2012 prices including inflation.

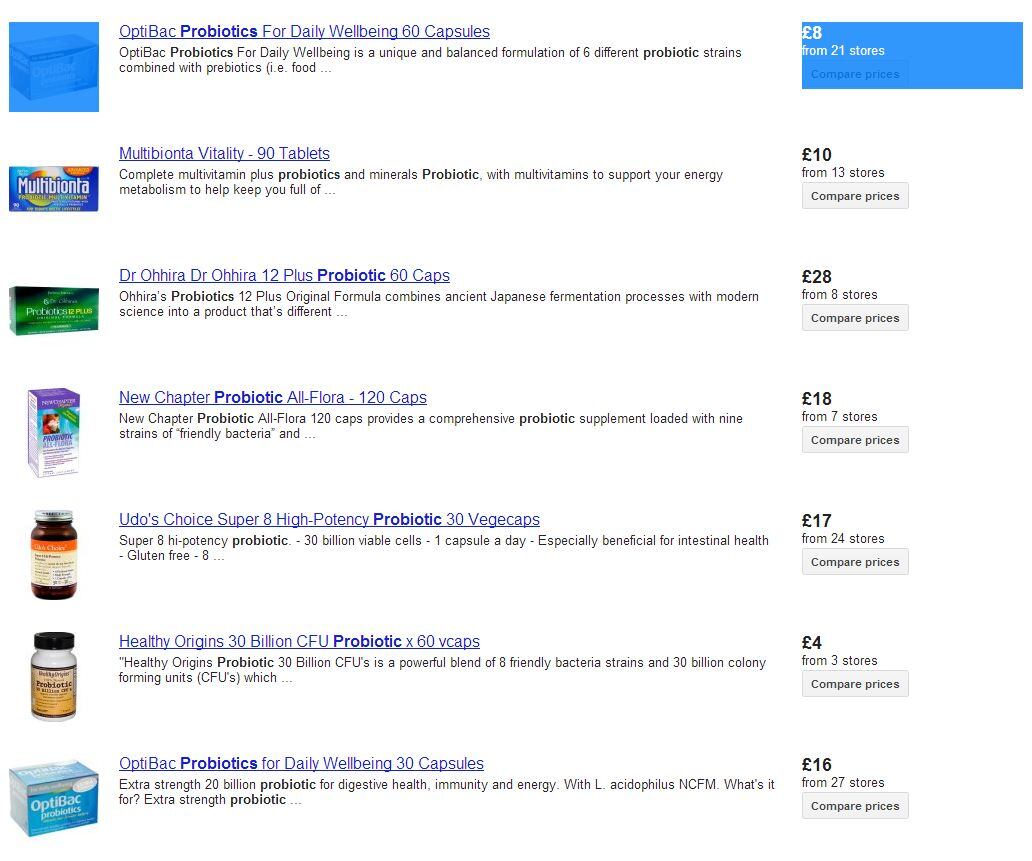

Pre- and probiotic gut, immunity and other health claims – along with the very use of the terms pre- and probiotic – have been banned in the EU since December 14 last year, although a scan of the web indicates many products that are yet to become compliant.

Analysts have been predicting an EU regulation-led crimping of the market for some years. Those predictions, even if the parlous economic situation cannot be discounted in the causation equation, would appear to be coming to fruition.

Turnaround...

The swift change in Euromonitor data can be seen against its own predictions from just a year ago where it said the world’s fourth biggest probiotic market – the UK (behind China, the US and Brazil) - would see something like 25% growth for a five year period between 2011 and 2016.

Rosier is the overall global market which will add about a third to hit €33.5bn in 2017, from €22bn last year, with North America, invigorated by the rise of Greek and functional yoghurt player Chobani, joining the likes of China, Brazil, Argentina, South Korea and Japan in recording double digit growth

Of the 20 EU countries polled, Poland, Hungary, Germany and Finland are the best performing.

Probiotech and Microbiota 2013

Hear what top companies like Danone and Yakult are doing about health claim changes at Probiotech and Microbiota 2013. The event joins two conferences to join the dots between the lab and leading edge pre- and probiotic products in food, supplements and cosmetics.

Find out more here.