In the past six months, 92% of consumers said they have purchased frozen dessert products, with 22% saying that they have purchased less frozen treats and have opted for more premium ice cream products.

“While little opportunity exists to acquire new customers in the universally-penetrated frozen-treat market, interest in premium and healthy options gives brands the opportunity to offer products that communicate health and wholeness, while also encouraging moderation, which can aid in increasing trials through smaller sizes,” said Beth Bloom, senior food and drink analyst at Mintel.

Health-conscious consumers rather indulge sparingly

According to the report, while health concerns are the main reason for cutting back, sales of traditionally health-focused products, including low-fat, low-calorie, and sugar free, struggle, while indulgence appears as a strong purchase driver.

“Putting a heavy focus on quality, taste and health will resonate with consumers, and emphasizing single-serving packs and messaging around the variety of products should appeal to Americans’ preference for snacking,” Bloom said.

According to Bloom, smaller packaging formats can imply moderation and boost purchase frequency.

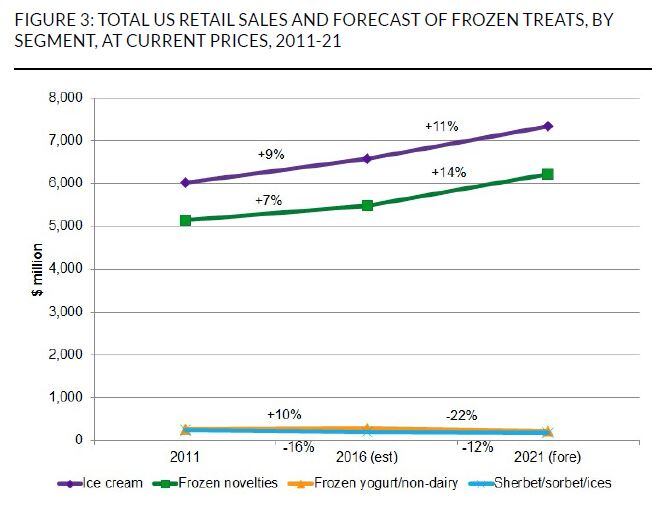

Among the lowest performing frozen treats was frozen yogurt, which, according to Mintel, experienced a 9.6% sales “meltdown” in the first six months of 2016.

Variety and focus on quality boosts engagement

The premium ice cream category has been able to avoid dollar losses despite overall declines in volume sales of ice cream by offering a variety of packaging and flavors to boost interest among different consumer groups.

According to the report, 22% of consumers purchase frozen treats that they consider premium and 34% agree that they are willing to pay more for such treats. More than one third (35%) of consumers agree that premium frozen treats taste better than regular frozen treats. All of these factors mean that consumers will pay more for what they consider a premium ice cream product, which is what has helped keep total ice cream sales afloat.

One in seven consumers even view premium ice cream products as “healthier” because of the category’s use of wholesome, local ingredients, as opposed to products that have eliminated sugar and fat content through artificial additives.

Sherbert, frozen yogurt, and ices were among the worst performing products, according to the report.