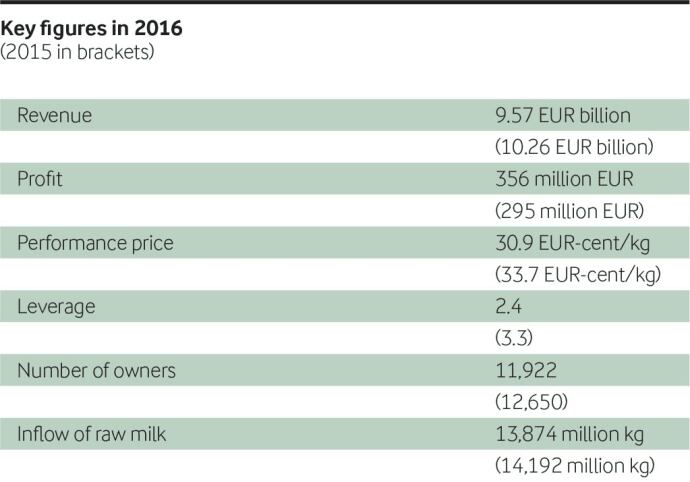

Group revenue decreased by 6.8% to €9.57bn/$10.1bn (compared to €10.26bn in 2015). This is a direct result of lower sales prices in the global market owing to high milk volumes in Europe in the first half of 2016 as well as unfavorable exchange rates.

In the second half of the year, Arla introduced increases in its prepaid milk price to farmers by nearly 30%, and said it expects annual revenue and performance price to improve in 2017.

Arla CFO Natalie Knight told DairyReporter, looking at 2017, she expects the company will continue to see further improvement of the underlying trends, “plus there will definitely be price increases.”

Arla said its financial results were above target on most measures, with net profit at 3.6% of sales, a strategic branded volume driven revenue growth of 5.2% and a growth in brand share to 44.5%.

Performing above peers

The 2016 performance price decreased 8.3% to 30.9 EUR-cent/kg, compared to 33.7 EUR-cent/kg in 2015.

The performance price reflects the company’s ability to add value to its owners’ milk in any given market situation, through innovation, brands, cost-saving programs, global growth, and other strategic and operational efforts.

Knight said the company generated an average of 5% more value per kg of owner milk than the average of its peers in 2016.

“Arla is very focused on our peer performance,” Knight said.

“It's one of our key KPIs as a group, because we believe our mission is about delivering the most value for our farmers' milk and the way we think we can best measure it is looking at relative performance. For ‘16, the fact that we were able to deliver 5% more than our competitors for our farmers, that's something we see as a big win in a tough environment.”

Arla’s peer group index is based on publicly available financial figures from comparable competitors in Northern European markets, representing 80% of all milk produced in the region.

Increasing branded sales volumes

Arla’s strategic brands all increased strategic branded volume driven revenue growth, which the company defined as revenue growth associated with growth in volumes from strategic branded products while keeping prices constant.

The Arla brand grew 4.5% (up from 2.5% in 2015), Lurpak improved 7.7% (6.1% in 2015), Castello increased by 3.0% (0.1% in 2015), and Puck saw 10.6% growth (9.9% in 2015).

Arla CEO Peder Tuborgh said Puck was driven by exceptional performance in the Middle East and North Africa, where the brand now holds the number one position in jar cheese across the region.

He added the Arla brand showed strong growth as a result of increased investment in innovative and specialized product ranges such as Arla Natural, Arla Lactofree, skyr and other high protein products, as well as infant nutritional formula such as Arla Baby & Me.

Strategic growth markets

Arla’s Europe division contributed 66% of Group revenue in 2016 with a volume driven revenue growth of 1.3%.

Arla’s strategic growth markets outside the EU achieved volume driven revenue growth rate of 9.5% in 2016 – primarily due to strong performance in China and Southeast Asia (up 31.2%) and Sub-Saharan Africa (up 15.8%).

Knight said southeast Asia was Arla’s fastest growing market in ‘16.

“I think it will definitely continue to be if not the strongest, one of the strongest, as we look at ‘17 and beyond. There's so much potential there.

“It's not just China, we're very strong in Bangladesh, we have growing positions in the Philippines and in Indonesia, and I think it's a place where there is a lot of opportunity for basic nutrition in many of those markets.”

Sub-Saharan Africa, and Nigeria in particular, Knight said, are going to grow very well this year.

“You look at Nigeria, for example, in 2030 it's going to have the same population as the US, and those are people who are looking for every opportunity they can to improve the quality of their nutrition, and it's something very positive.

“I think there's a lot of things there that will help our business and we're certainly committed to doing it the right way.”

The US looks very good, and Australia/New Zealand is growing strongly, Knight said.

“We've got a lot of momentum in almost all of the international markets. I'm very bullish about all of our international business. We grew almost 10% in ‘16, and I think we expect an acceleration of that trend in ‘17.”

Innovation

Arla Foods Ingredients, a 100% owned Arla Foods subsidiary, reported a 5% increase in revenue to €545m ($573m) in 2016 due an improved product mix and growing sales volumes.

“Product innovation is key for us,” Knight said.

“We talk about 'we want to grow brands', but how do you grow brands, how do you grow internationally? It's all driven by innovation.

“On the Arla Foods Ingredients side, that's where we've got really groundbreaking stuff. It's really also a place where we can drive that big focus in the market on proteins, that I think is very strong.”

Cumulative costs continue to decline

Keeping strict control on cost and rigorously optimising processes is critical to Arla’s success and competitive positioning, Knight said, noting total operational cost in 2016 was reduced by 1.4% excluding the cost of raw milk.

She said that a year ago, the company launched a new efficiency program to reduce cumulative costs by €400m ($421m) by 2020.

“In 2016, we did two big things, we delivered €100m ($105m) in savings, and we'll continue to do that in ‘17 and beyond,” Knight said.

“It's good business, and it's something you have to do in a low margin business like ours, we are always looking to take cost out. In ‘16 we did restructure, and we did take out about 540 white collar workers, so I'm certainly not expecting in ‘17 that you're going to see any big personnel reductions at our company.”

Expectations for 2017

In 2017, Arla expects Group revenue to grow significantly owing to a continued growth in the company’s branded business as well as higher prices in the market globally.

UK division results

The UK, Arla’s largest market, performed strongly against a tough backdrop by increasing its market share across most of its categories.

It achieved this by launching a wide range of innovative products, achieving its highest rate of branded products to date and working closely with retailer customers to maintain a leading position in own-label.

Overall revenue in the UK decreased from €2.5bn ($2.6bn) in 2015 to €2.2bn ($2.3bn) in 2016.

Arla Foods UK delivered its ambitions of growing its branded business with a focus on its three strategic brands; Arla, Lurpak and Castello.

Arla branded products achieved volume driven growth of 7.6% compared to 5.2% in 2015.

In 2016, Arla branded milk grew 12%, and added £95m ($118m) to the milk category with launches of Arla B.O.B., Arla Farmers Milk, Arla Organic Farm Milk and Arla Cravendale 250ml.

In addition, Morrisons Milk for Farmers, launched in 2015, accounted for around 15% of sales within the categories that it competes in.

Arla Lactofree product range saw another year of double-digit growth with +18% growth (23% in 2015).

Arla yogurt category, which the business first entered in 2015, has more than doubled year-on-year (+116%).

Arla’s speciality cheese brand Castello accelerated its growth in 2016 to 18%.

Tomas Pietrangeli, managing director, Arla Foods UK, said the company was able to deliver a strong set of results by driving growth in the UK through its portfolio of popular products, and delivering efficiencies and cost savings in the supply chain.

“We are, however, conscious of the longer-term context and potential impact of Brexit. That’s why we’re working closely with the wider food and farming industry, and with Government, to try and maximize opportunities of Brexit, whilst mitigating potential risks,” Pietrangeli said.