Speaking to FoodNavigator-USA about the "emotive" new look – which was created in-house and will roll out across all Chobani branded products, factories and cafes – chief demand officer Peter McGuinness said: “Yogurt is this amazing nutrient-dense food and it’s high time packaging caught up with that. The new design is friendlier and more accessible. It's also bolder: you can see the [new] brand five, seven, 10-feet from shelf.

“For the core cups, we’ve gone from shiny white to a natural off white linen color that connotes craft, warms things up a little bit and is distinct from all the other white shiny objects out there with photos of perfect strawberries and blueberries.

“We’ve gone for watercolors and designs that are yummy, creative and optimistic; they look vibrant and beautiful on shelf."

Significant uptick in marketing spend in 2018

The new look will be supported by a significant increase in marketing spending weighted towards the first half of 2018, added McGuinness, who said Chobani was planning more innovations within the yogurt segment, but was also considering moves outside the category, although he would not share details or timing.

“We’re going to spend 30% more next year on marketing than we did this year, and this year was our highest spend ever. We believe yogurt is underpenetrated in America for no good reason, and we want to bring magic back to the category.

“If you look at the wounds the big names in the category have experienced this year, they are all self-inflicted. There was too much imitation, irrational pricing, and rampant reformulation that was not successful… [Dannon's] Oikos blue label reformulated and then went back to the original recipe because people didn't like it; Yoplait cut sugar in its core range and lost a huge part of its customer base. There was also ineffective marketing. But we’re growing, so we know that the issue isn’t with yogurt [per se].

“In 2017, we surpassed Yoplait to be the second largest yogurt company [behind Danonewave]. We are the only major manufacturer that’s growing and we had double-digit top line growth in 2017 [Nielsen data shows Chobani's sales were up 5% year-on-year in the latest 13 weeks against a category experiencing sales declines of 2.3% over the same period, but only covers measured channels and doesn’t include data from club, foodservice, e-commerce and other channels in which Chobani is performing strongly, claimed McGuinness].

“We think we can bring dramatic growth back to the category because consumption is not where it could be.”

“When you’re 10 years young, you kind of step back and look at where you’ve been and where you’re going and it was just one of those inflection points, where we felt we could sharpen and evolve our mission and vision, surprise and delight and be more emotive in how we look and feel. And the best time to do this is when you don’t have to do it.”

Peter McGuinness, chief demand officer, Chobani

Chobani is “playing around with promotional strategies, pack sizes and formats for [new non-Greek launch] Smooth, but we’re not renovating the recipe,” says chief demand officer Peter McGuinness.

“We’re trying to get people leaving the yogurt category to stay there because we are offering a better alternative [to the non-Greek options out there].”

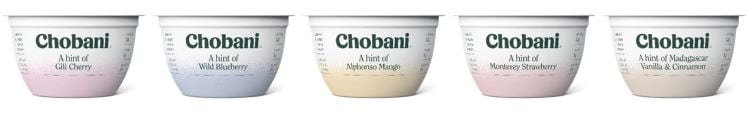

Simply 100 withdrawn; Chobani ‘Hint of’ launching

When it comes to category trends, consumers are looking for high protein and low sugar, without high-intensity sweeteners, even 'natural' ones, said McGuinness, who said that Chobani’s lower calorie Simply 100 range - launched in December 2013 and sweetened with sugar, stevia leaf extract and monk fruit – had been discontinued about six months ago.

He explained: “You only have to look at the data to see that diet is not the fastest growing segment in the category. We don’t think diet yogurt is the future. Consumers who are sugar conscious now tend to eat plain yogurt and add their own toppings – fruit or nuts – or make their own parfaits and smoothies, so so we are seeing consumption increase in plain yogurt on the back of that trend."

High protein, low sugar, mild taste

He added: “What they really want is a low sugar, high-protein option with flavor, which is what our new product - Hint of… is addressing. It’s a blended Greek yogurt with single digit [9 grams of] sugar, double digit [12 grams of] protein [per 5.3oz serving] with a milder flavor – we’re using different cultures to those we use in our core range – and varietal fruit: Wild blueberry, Monterey strawberry, Alphonso mango, Gili cherry, and Madagascar vanilla cinnamon…

“It’s coming out this month in [selected regions] and will go national for the July 2018 reset. And we’re not using sweeteners, not even stevia.”

Chobani has withdrawn its Oats and savory meze dip lines amid lackluster sales… but both concepts have legs, and will return, in some form, to the US market, president and COO Tim Brown told FoodNavigator-USA editor Elaine Watson at the FOOD VISION USA conference in Chicago earlier this month.