Speaking at the launch of the Irish Food Board’s Bord Bia’s Export Performance and Prospects 2017-2018 report, The Irish Minister for Agriculture, Food and the Marine, Michael Creed TD, said the value of Irish food, drink and horticulture exports increased by 13% in 2017, to reach €12.6bn ($15.1bn) for the first time.

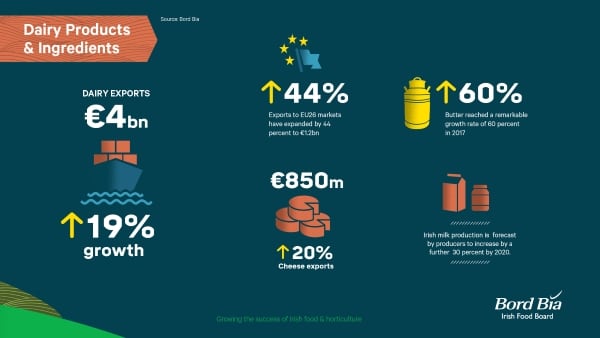

Dairy was the most significant sector, with an export value of €4.02bn ($4.8bn) – representing a third of all food and drink exports – up 19% on the previous year.

Speaking at the launch, Irish Food Board CEO, Tara McCarthy, said the value of Ireland’s butter exports rose by a 60% in 2017 alone, to reach €879m ($1.05bn).

“This growth accounted for over half of the total increase in dairy exports,” McCarthy said.

In addition to the UK, exports to other EU countries rose by 16% to more than €4bn ($4.8bn), mainly driven by strong dairy exports, which rose by more than 40%, to €1.2bn ($1.43bn).

Dairy accounts for 45% of all sales to international markets, with China remaining the second biggest market after the UK.

Dairy outlook good

The report stated the high levels of demand witnessed in the dairy sector in 2017 look set to continue in 2018 with butter and powders in strong growth mode in key EU and international markets.

Specialized nutritional powders remain the leading dairy export at about €1.3bn ($1.55bn), but growth has been flat. The largest increase is for butter which rose by more than 60% to nearly €900m ($1.08bn), driven by high demand and prices on EU and international markets.

The setbacks in the cheese market recorded in 2016 have been reversed – with the export market expanding by 22% to about €848m ($1.01bn). Trade to the UK still comprises about 50% of the market.

Other dairy products that enjoyed substantial growth this year were skimmed and whole milk powders, each attained export sales of €180m ($215m), up 46% and 55% respectively.

Oversupply due to increased production possible

With Ireland’s growing dairy herd and increased cow productivity, Irish milk production increased by around 8%, or more than 500m liters, reaching 7.1bn liters for 2017.

Irish milk production is forecast to increase by a further 30% by 2020.

The report noted that it remains likely the global increase in production in the second half of 2017 will continue into the first half of 2018, with potential oversupply on the market.

Global import demand can typically support milk expansion growth of circa 1.5% globally. Above this level, dairy expansion can result in a market oversupply.

Growing EU and global milk supplies along with EU SMP intervention stocks are causing some market uncertainty and a current bearish market sentiment, the report concluded.