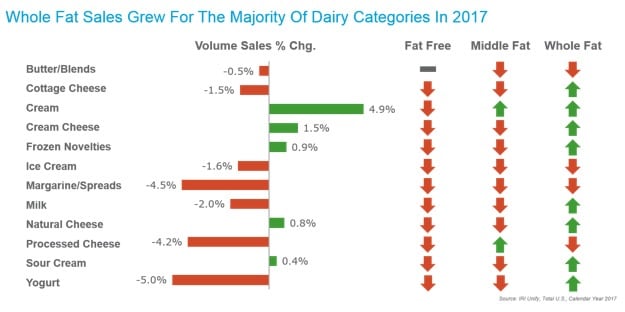

Volume sales of whole-fat dairy grew in eight of the 12 sub-categories of dairy while fat-free volumes sales declined across the board, according to IRI data.*

In the cream cheese category, for example, volume sales of fat-free varieties decreased 23.1%, middle-fat decreased by 4.7%, while whole-fat cream cheese increased by 2.7% in 2017. Whole-fat milk has also provided consistent growth for the milk category.

“However, not all dairy products are experiencing the benefits of consumers’ new interest in whole fats. Off-trend categories such as margarine and processed cheese have struggled as consumers’ interest in simpler and less processed foods continues to grow,” said John Crawford, IRI VP of client insights, dairy.

As such, fat-free processed cheese saw the largest declines in volumes sales last year, contracting 26%. Whole-fat processed cheese also declined signaling that consumers are interested in whole-fat and more naturally-positioned products.

Whole-fat butter saw a sales decline of 0.5% in 2017, however butter sales have been continuing to gain traction over the past few years with consumers increasingly opting for full-fat butter over more processed margarine/spreads (-26% in dollar sales), according to IRI.

Whole-fat dairy buyers

IRI ShopperSights data revealed that whole-fat dairy buyers tend to be married with families, with strong purchase behavior among Hispanic consumers. This is seen clearly in the whole-fat yogurt segment whose buyers tend to be married (84%) and have kids at home (61%), and more are Hispanic (31%).

Only 20% of middle-fat buyers are Hispanic, but marriage rates and kids at home are similar to whole-fat yogurt buyers. On the other hand, 34% of fat-free yogurt buyers have kids at home and only 6% of fat-free yogurt buyers are Hispanic.

“The path CPG manufacturers and retailers take to win the whole-fat market should be as unique as the consumers they serve,” Crawford said.

According to Crawford, for dairy CPG players to reach their intended audience, companies need to deliver a number of targeted and varied messages depending on the audience.

“Whether through social media, sporting events or television, each type of buyer can be targeted based on their demographics and purchase behavior. Offering relevant messaging and a variety of products to meet various consumer needs, helps CPG manufacturers and retailers can separate themselves from competition and win new audiences.”

How to target dairy shoppers

“Not surprisingly, convenience continues to be a growth driver for consumers,” Crawford said.

“We’re all finding that we’re busier than ever and looking for shortcuts everywhere and dairy is certainly poised to provide solutions to consumers who are certainly becoming increasingly time crunched.”

One way to target shoppers looking for convenience is through revamped assortment and merchandising at retail, which is expanding beyond the traditional supermarket format.

According to IRI, retailers who are playing up the dairy section in the form of more grab & go options such as pre-sliced deli ‘natural’ cheeses (+3.0% in 2017), yogurt drinks (+11.8%), and snack kits featuring dairy items, have seen significant sales growth over the past few years.

This growth is occurring outside the conventional grocery channel and across other channels who are also converting the traditional deli section into convenient grab & go sections. In fact, deli cheese (service, grab & go, and specialty) has grown 1.8% over the past three years to $2.52bn in sales last year.

“Deli (dairy, bakery, and meat items) which has often been thought of as a traditional mainstay of supermarket retail is absolutely now, due to the proliferation of convenience items, showing up in convenience stores. In fact, those items are growing much faster in mass, specialty, drug, and even c-stores than they are traditional supermarkets,” Jonna Parker, IRI principal, Fresh Center of Excellence, said.

Parker added that the perimeter of the store is now looked to by consumers as an area to provide “any time of day snacking solutions” ranging from early morning to late evening, and retailers should respond accordingly by provide "cart-stopping" displays and merchandising.

*Source: IRI, Total US, Calendar Year 2017