Launching Bord Bia’s Export Performance and Prospects 2018/2019 report, Ireland’s Minister for Agriculture, Food and the Marine, Michael Creed, said last year marked the highest ever volume of Irish exports, and the ninth consecutive year of volume growth.

Overview of 2018 exports

According to Bord Bia’s new report, Ireland’s largest export categories, meat and dairy, which account for two thirds (66%) of total exports, remained stable. Bord Bia CEO, Tara McCarthy noted that total export volume increased significantly across many categories this year, although this was counteracted by global price volatility. While Irish producers exported more in volume terms (+50,000 tonnes), the Euro value recorded for those exports declined.

McCarthy said, “Last year was an extraordinary year of instability, however Irish food and drink exporters continued to trade resiliently through the uncertain environment. To exceed export values of €12bn ($13.7bn) for a second year running, and reach new record levels in terms of volume, is hugely impressive. It demonstrates the buoyancy, commitment and ambition of the Irish agri-food sector, which is well positioned to exploit the relentless growth in the global demand for food.”

Dairy figures

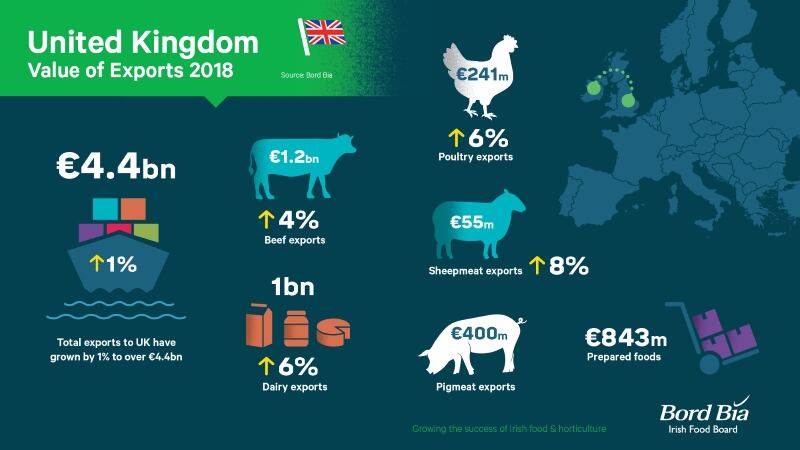

Dairy was the strongest performer in terms of export volume growth in 2018, with volumes up 5% compared to 2017. The value of dairy exports remained stable, exceeding €4bn ($4.6bn) for the second year in a row. Butter had an exceptional year in the US and continental Europe and for the first time the value of Irish butter exports exceeded €1bn ($1.1bn) for the year, up 22% on 2017’s value. More than 50% of Ireland’s cheese exports – of which 83% is cheddar – heads to the UK.

The overall value for prepared foods declined by 16% to €1.8bn ($2.1bn), primarily due to a significant decline in the value of protein powder exports to the US in 2018. However, confectionery, chocolate and frozen food exports saw growth last year, driven mainly by innovation, new product development and newer channels for exporters in mature markets.

Looking ahead

McCarthy said she remains optimistic about the industry’s prospects for the year ahead.

“Market and trade insight suggest that the global demand for Irish food and drink will remain positive in 2019. In both dairy and in animal protein the supply demand dynamic is positive for exporting nations like Ireland.

“Demand will continue to outstrip supply and new consumers tend to be in countries with low dairy or animal protein self-sufficiency In line with Bord Bia’s Market Prioritisation work, growth in dairy, meats and seafood in particular will come to a great extent from emerging economies in Asia and elsewhere.”