Dustin Boughton, procurement, at Maxum Foods said the fundamentals underpinning the global market outlook remain positive.

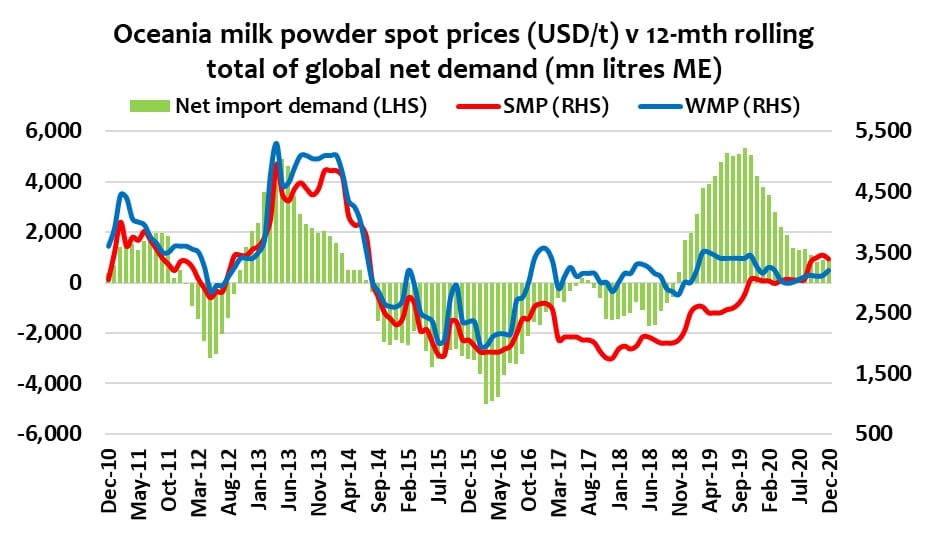

While there has been a slight increase in milk output growth in major commodity exporters in late 2019, aggregate demand – in domestic and export markets – remained well ahead of the growth in milk supply.

The tight balance in dairy markets will gradually ease into 2020 with improving growth in milk supply as producers in the EU and US respond to better milk prices and farm margins, Boughton said, while the flow-on of higher product prices and the reduced availability of SMP may slow trade. The rapidly spreading coronavirus will however impact dairy trade in the short-term and cannot be ignored in our base outlook.

Dry weather in NZ, limits on growth due to weather and feed issues in parts of Europe, and ongoing challenges in Australia will help keep expansion of milk output in major exporters below 1% in Q1-2020, increasing to 1.1% in Q2-2020, Boughton added.

Skim Milk Powder

SMP trade slowed 4.0% YOY in November, despite a continued resurgence in US trade, which grew 44% to lift US exports by 27% for the three months to November. The US growth in November was again mostly due to stronger sales into SE Asia, where it is winning share due to a price advantage.

Boughton said that since the clearance of intervention began, the EU accounted for 95% of the growth (246,000t) in global trade of SMP to November 2019. EU exports in November were 60,003t –down 11.6% YOY and a 15-month low. While the US and Canada grew trade, exports from every other major supplier fell in November.

Whole Milk Powder

Spot values are moving apart with NZ prices softening in December and recovering in January and remain relatively steady, he added. The fear of disruption to trade and logistics in China due to coronavirus weakened spot and futures prices late in the month.

Cheese

The report said expansion of cheese imports by Russia still represented a significant portion (43%) of overall market growth in the 11 months to November, while the growth in US imports ahead of the imposition of tariffs on EU product added 16% in that period. Excluding these, the market grew just 2.3% in 2019.

Butter

Butter trade is improving, according to Boughton, with total tonnage up 32% YOY in November but AMF trade worsened and fell 18% YOY. Spot prices weakened in December as NZ values fell below $4,000/t, narrowing the gap between EU and NZ values. NZ spot prices have since recovered with signs that demand has gained some traction at these lower prices.

Whey

The decline in global trade in whey products for the 11 months to November was 6.1%, mostly the result of weaker shipments into China & HK which imported 26% less, due to the culling of their pig herd to address swine fever and the imposition of punitive tariffs against US products.