And it's not just toilet rolls that are flying off the shelves: powdered milk sales are up 375% since the company started tracking 756 categories on February 15.

Marta Cyhan, chief marketing officer at Catalina, said the company’s buyer intelligence database captures up to three years of purchase history, and more than 2bn Unique Product Codes are scanned daily, so the company can provide customers with near real-time insights and sales data that help inform their marketing decisions and even stocking and supply chain activities.

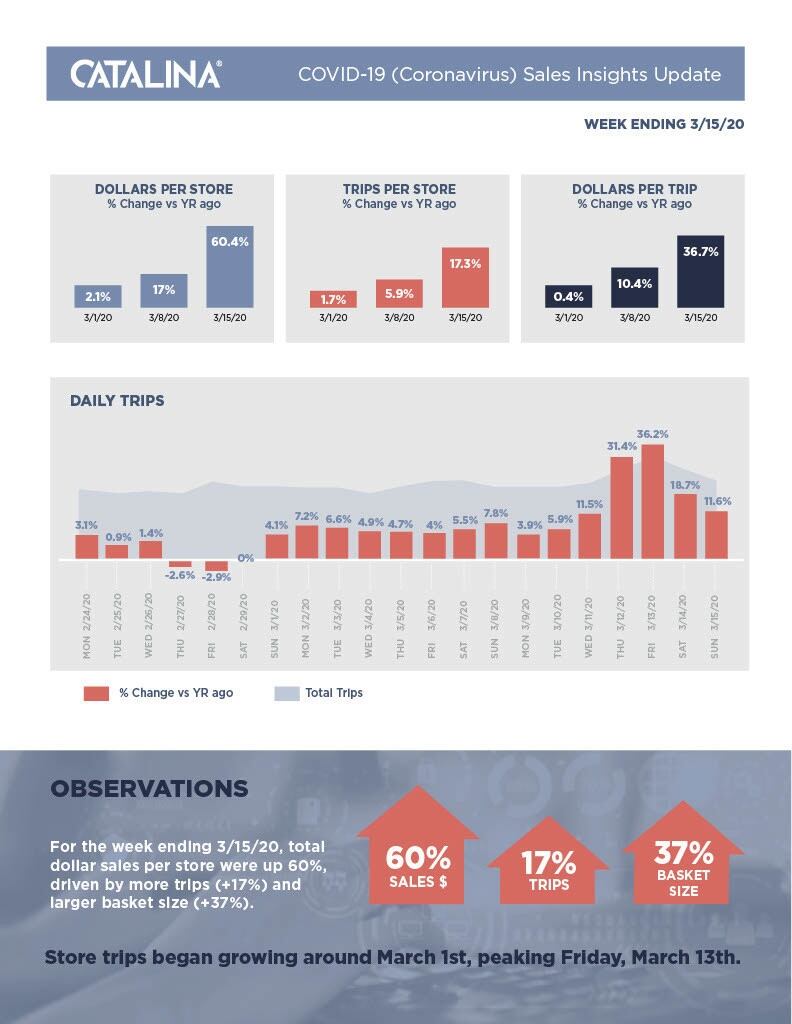

"Store trips began growing around March 1 and really took off last week - with visits peaking around March 13. For the week ending March 14, total dollar sales per store were up 60%, driven by 17% more shopping trips and basket sizes that increased an average of 37% versus the prior year," Cyhan said.

Cyhan said that as well as milk powder, other previously declining categories have seen increases, including dry, hearty soups, up 235%, and aluminum foil, up 86%.

And, because of lifestyle changes, at least in the short term as workers stay at home, entertainment such as books and magazines have seen a rise in sales, with books up 42% and games and puzzles rising 23%. And with people not heading into the office, cosmetics, perfumes and grooming products are seeing a decline.

"Our role as a strategic partner to retailers and brands is to share data insights that help them unearth the facts, understand buyer behavior, and plan accordingly to continue meeting the needs of their shoppers, while also preparing for the months ahead once the precautionary measures surrounding COVID-19 have passed and people return to their normal routines," Cyhan said.