The event focused on the status of the dairy world, and the way in and out of the crisis.

The conference noted that milk production growth at 1.4% was significantly below the long-term average (2.3%) in 2019. This was driven mainly by India, Oceania, Africa and the Middle East. Meanwhile, the rising popularity of milk alternatives in rich countries and lower milk availability in emerging economies slowed down demand growth.

Dairy farm economics looked more positive as the world milk price increased by 6% to a level of $37.3/100kg in 2019. Still, for many farmers, especially in the US and EU, this milk price is often “too little to live on and too much to die,” according to managing director of the IFCN Dairy Research Centre, Dr Torsten Hemme.

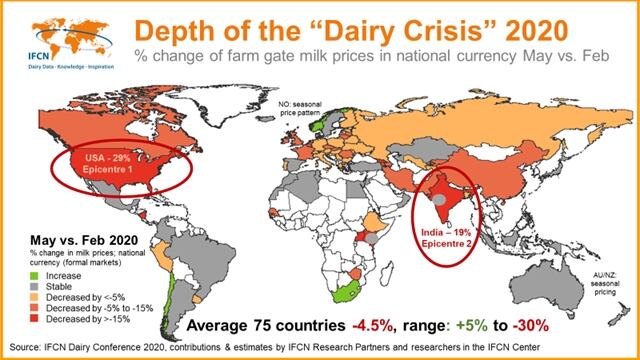

The performance of the national farm gate milk price can be used as an indicator for a crisis, the IFCN said, adding it seems that there is no major crisis yet as milk prices on average declined by 4.6%.

Nevertheless, there are two large countries that could be considered as the “epicenter of the dairy crisis”: the US and India, with decreases of 29% and 19%, respectively. A poll taken of the dairy experts in attendance revealed that one third considered their country to be only at the beginning of the crisis. However, two thirds of participants thought the bottom of the crisis has already been reached.

The outlook for the world milk price in 2020 remains complex, the IFCN said, adding future markets and the views of analysts are not aligned. As of early June, dairy future markets expect a fast milk price recovery to reach a level of $35/100kg milk by July. This can be described as a “V” shape price scenario. The majority of dairy experts at the conference expect a U-shaped recovery and thus a longer period of time until previous price levels will be reached once again. The reason is solid milk supply growth in 2020 so far coupled with a high chance of declining per capita demand as a result of the economic crisis.

Further research will be required on dairy stocks and the potential shift of dairy demand in developing countries from informal to formal dairy products, which could have a positive impact on dairy imports.

By the end of the conference, the IFCN said it became clear a real-time monitoring of dairy indicators is key. The IFCN said it will update its research in the coming months to help those in the dairy industry.