A co-product from the manufacturing of whey/milk protein concentrate (WPC/MPC), permeate is a high-lactose, mineral rich, dairy ingredient produced through the removal of protein and other solids from skim milk or whey using physical separation techniques.

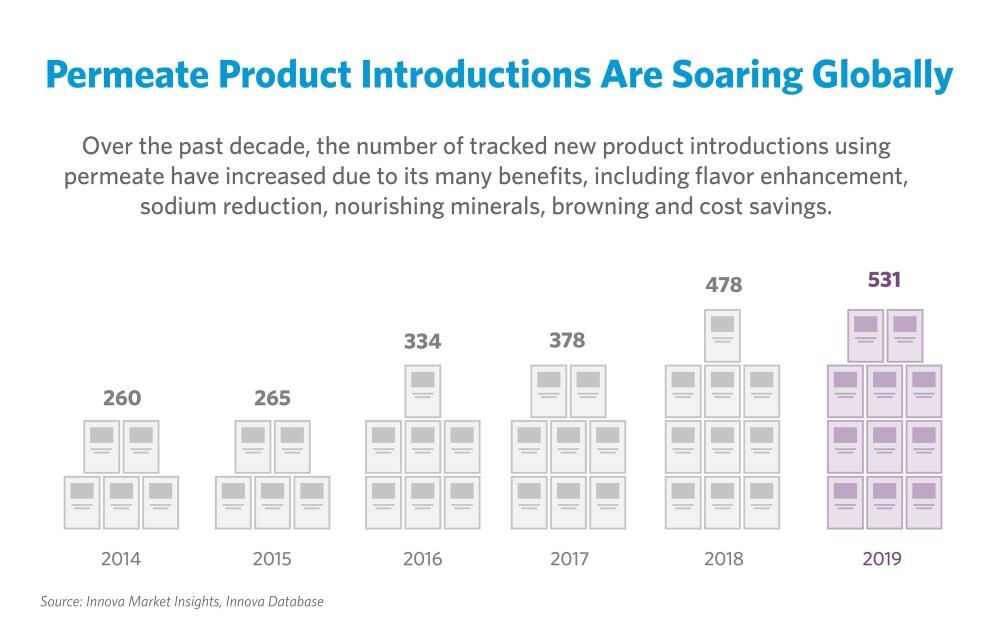

According to an analysis of tracking data from the Innova Market Insights' Innova Database, new product introductions containing permeate reached an all-time high of 531 products in 2019. This was up 11% over 2018 and double the number of introductions in 2015.

"The global trends show why permeate is a strategic business opportunity for product formulators looking for functionality and value," said Annie Bienvenue, vice president, global ingredients technical marketing services for USDEC.

"It's aligned with consumer and category trends, leaves room for even more potential and limitless opportunities in China as a market completely new to permeate in food applications, alongside other growth markets for permeate around the world."

The Innova tracking data also showed permeate usage is expanding and diversifying globally, with launch share notably rising in Latin America, Asia and the Middle East. The geographic split for 2019 was 50/50 with North America and Western Europe accounting for one-half and the rest of the world the remaining half.

This contrasts with prior years where the majority of launches were in the early adopting regions of North America and Western Europe, specifically 58% in 2018 and 63% in 2015. On a country level, the US continued to lead the way as the top market for new product introductions with permeate, with one in five products launched in the US. Brazil, the UK, France and the Philippines round out the top five markets respectively.

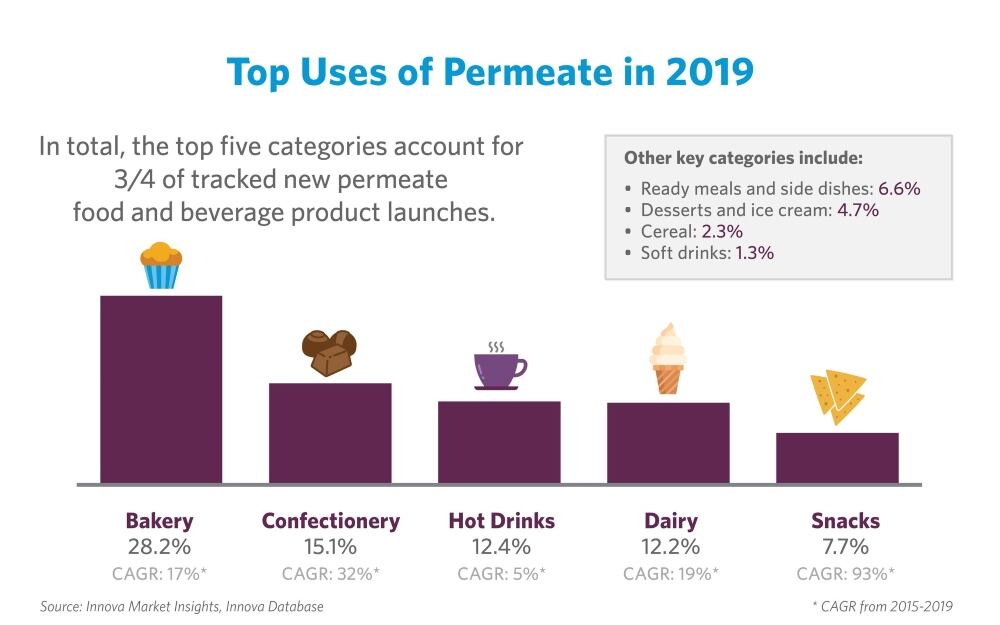

While permeate is used and tracked as an ingredient across many categories, bakery leads with a 28.2% share of new product launches using permeate in 2019, or one in four products launched. Confectionery ranks second at 15.1%, followed by hot drinks at 12.4%, dairy at 12.2% and snacks at 7.7%. These categories have all seen growth from 2014 to 2019.

Dairy foods, such as soft serve ice cream, are also a popular category, with a 19% CAGR during the same period.

"US suppliers have invested in research and development efforts to optimize permeate flavor and functionality in a variety of food and beverage applications and can also provide customers with technical and new product ideation support as delivered through the recent webinar in China," said Kristi Saitama, vice president, global ingredients marketing for USDEC.

"We are excited that the world increasingly sees permeate as an attractive ingredient solution, and look forward to customers' new creations."

The US is the leading global producer of permeate, with an estimated volume of 523,200 metric tons in 2019, a 16% increase from 2014. US permeate production is projected to continue to increase over time, as new facilities come online.