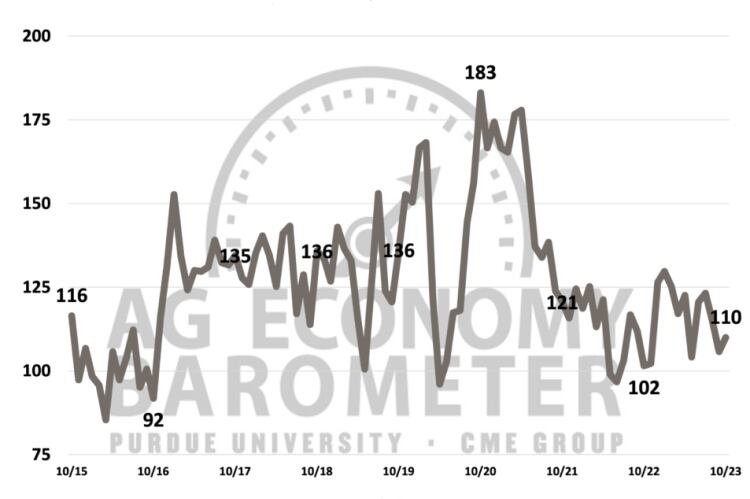

The Purdue University/CME Group Ag Economy Barometer index rose 4 points to a reading of 110 in October. Respondents in the latest survey were slightly less concerned about the risk of lower prices for crops and livestock and felt marginally better about their operations’ finances.

Both the index of current conditions (up 3 points to 101) and the index of future expectations (up 5 points to 114) rose, while the farm financial performance index also went up 6 points, the highest it’s been since April 2023 and 7% higher on last year’s reading.

Investment index hits 'lowest point'

However, the farm capital investment index was down 4 points, to a reading of 35 - the lowest of the year. In October, nearly 8 out of 10 (78%) respondents said it was a bad time to make large investments in their farm operation, while just 13% of farmers said it was a good time to make large investments. Among those who said it’s a bad time to invest, the most commonly cited reason was rising interest rates, chosen by 41% of respondents, up one point from September. Of those who said it is a good time to make large investments in their farm operation, 24% stated “strong cash flows,” down from 32% who felt that way in September, and 20% pointed to “expansion opportunities” up from 6% in September.

Just over one-third (35%) of producers in this month’s survey said they expect farmland values to rise in their area in the upcoming year, while nearly two-thirds (65%) of survey respondents expect farmland values to rise over the next 5 years.

As a result, the short-term farmland value expectations Index changed little, dropping just 1 point compared to a month earlier, while the long-term farmland value expectations index rose 3 points. Key reasons cited by producers for optimism about farmland values over the next five years continue to be non-farm investor demand, followed by inflation.

October’s survey asked corn and soybean producers if they had made any changes to their farming operations in response to changing weather patterns. The results showed that around a quarter of respondents had implemented changes to better deal with weather challenges, with the biggest operational changes including increased use of no-till (25% of those surveyed), changed mix of crops planted (23%), planting of more drought-resistant varieties (20%), tile drainage installations (9%) and irrigation installations (9%).