The types of innovative ingredients used in infant formulas have evolved over the years, as companies tried to develop formulas which they claim can mimic the human breast milk.

China’s Junlebao for instance, is hoping to mimic the fat structure in human breast milk through the addition of OPO (oleic-palmitic-oleic).

French dairy giant Danone, on the other hand, has developed products containing “large milk lipid droplets” that mimic the structure seen in breast milk.

Human milk oligosaccharides, on the other hand, have also garnered attention in recent years amid growing scientific findings and regulatory approvals.

Nestle’s newly minted CEO Laurent Freixe even said in the company’s FY24 results presentation that the company’s proprietary blend of probiotics and HMOs, commercially sold as “Sinergity” was “one of our big bets” for its infant nutrition business.

In this series of VitamINSIGHTS, we will shine the spotlight on trending innovations in the infant formula sector across Asia-Pacific (APAC), with insights from Vinamilk, The a2 Milk Company, industry experts and more.

Local players join the playing field – the case of Vietnam’s Vinamilk

While the HMOs infant formula sector is dominated by MNCs, local players are eyeing for a slice of the market.

In Vietnam for example, leading dairy company Vinamilk launched a formula milk containing six HMOs - said to be the first-of-its-kind in Vietnam last December.

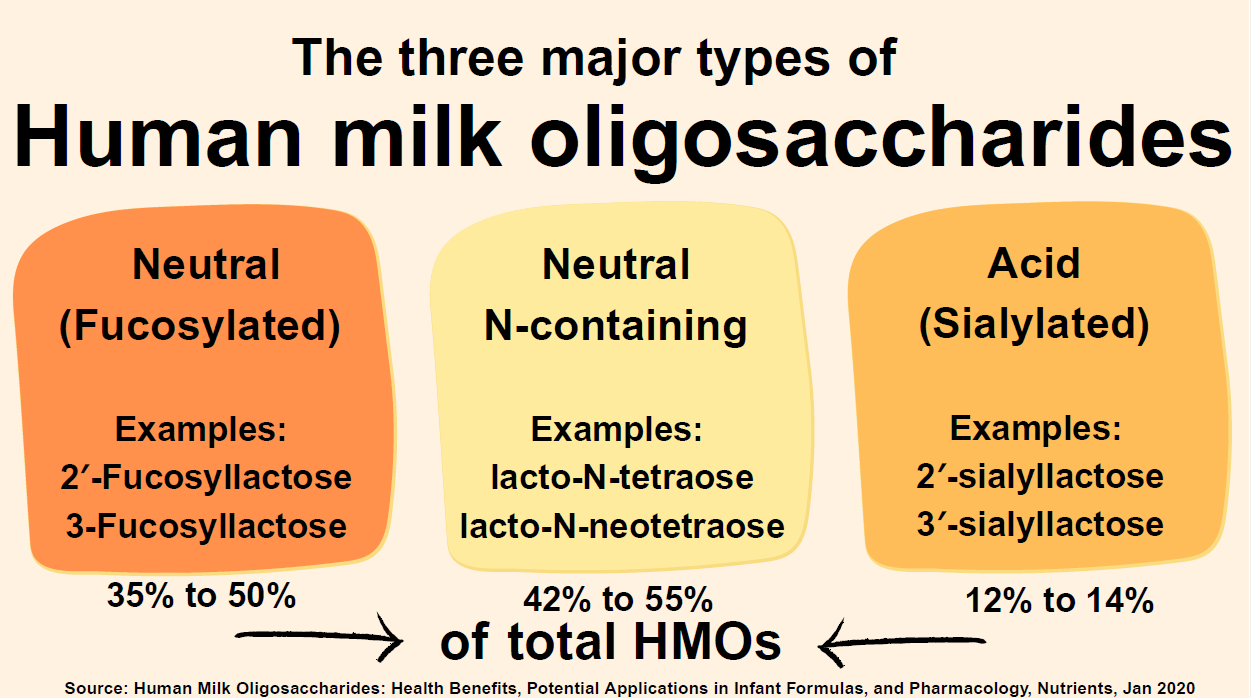

Available in the market as Vinamilk Optimum, it consists of the HMOs from the three main HMO groups.

They are the fucosylated HMOs 2’-FL, 3-FL, DFL, sialylated HMOs 3’-SL, 6’-SL, and non-sialylated HMOs LNT.

According to the company, these six HMOs were chosen as they form about 58 per cent of the total HMOs found in breast milk.

They also play a crucial role in supporting digestive and immune system health.

There are two products under the Vinamilk Optimum banner - Optimum Gold for digestive health and Optimum Colos for immune support.

Optimum Gold, for example, focuses on digestive support with the use of the six HMOs, while Optimum Colos specialises in immune defence with a dual-layer protection system: an inner layer of IgG from colostrum and an outer layer of IgA from HMOs and human milk probiotics (HMPs) isolated from breast milk.

Aside from HMOs, the products also consist of whey protein enriched with alpha-lactalbumin at 2.2 g/L, soluble fibres galacto-oligosaccharides (GOS) and fructo-oligosaccharides (FOS), and probiotics BB-12 and LGG.

The launch builds up on the company’s first HMO infant formula containing 2’-FL introduced back in 2019.

The company believes that the launch can help address an existing market vacuum.

“In recent years, HMOs have become more familiar to Vietnamese consumers, especially with the introduction of formula milk products containing HMOs.

“Abbott Similac and Vinamilk Optimum (2’-FL) were the first to introduce HMOs in 2019.

“In 2021, Abbott Similac launched a complex of five HMOs, setting a new industry trend by combining 2’-FL, LNT, 3-SL, 6’-SL, and either 3-FL or DFL.

“However, no new combinations have emerged until 2024, when Vinamilk Optimum introduced Vietnam’s first formula with a complex of six HMOs, distinguishing itself from Abbott Similac and Nestlé NAN by incorporating both DFL and 3-FL,” said Nguyen Quang Tri, marketing executive director, Vinamilk.

He added that post-COVID, nutrients that support immune defence among young children have gained more attention in Vietnam and that includes HMOs.

“The COVID-19 pandemic has heightened consumer interest in health, especially for young children. As a result, nutrients that enhance immune defence - whether directly, like colostrum, or indirectly, like HMOs and HMPs - have gained more attention in Vietnam.”

He said that HMOs and other ingredients that support digestive health and immune defence would continue to be the focus for their infant formula milk innovation.

Watch the following video as Nguyen Quang explains more.

Other than Vinamilk, another local Vietnamese company NutiFood has also introduced the HMO 2’-FL into its infant nutrition products through a partnership with BASF back in 2021.

Nestlé Vietnam, on the other hand, launched NAN Optipro Plus 4 formula products containing five HMOs, Bifidobacteria and Optipro protein in 2023.

More regulatory approval of HMOs expected in China – dairy analyst

The discussion would not be complete without a look into the China market.

This is especially since the Chinese regulators have approved two types of HMOs, namely 2’-FL and LnNT for use in infant formulas since 2023.

China’s HMO ingredients approval process consists of two stages.

One is the assessment by the Ministry of Agriculture and Rural Affairs (MARA) on whether genetically modified bacteria strains used to ferment HMOs are safe.

The second stage is led by the Center for Food Safety Risk Assessment (CFSA), which will assess HMOs based on the food additive regulations.

Companies like IFF, dsm-firmenich, and Mengniu – through its ingredient arm Synaura Biotechnology (Shanghai) – were among the first to have their HMO ingredients approved back in 2023.

Mengniu has also incorporated HMOs into its finished products, including its Enzhi (恩至) series infant formula and Future Star liquid milk for children.

Infant formula giant Feihe was another China company that has incorporated HMOs into its infant formula products, with Super-Zhuorui Xingfeifan Zhuorui (星飞帆卓睿) as an example.

Prior to that, HMOs formulas would need to enter the China market via cross-border e-commerce (CBEC).

As of 2024, the China authorities have also assessed and conducted public consultation on the use of other HMOs like 3-FL, LNT, LNnT, 3’-SL, and 6’-SL in infant formulas.

Dairy industry analyst Song Liang, who also leads an expert group at the China State Farm Dairy Alliance (CSFDA) told us that as HMOs are set to become a crucial feature in China’s infant formula market.

Over 200 HMOs have been discovered in human breast milk so far.

Song believes that the China regulator will be assessing and approving more HMOs for use in infant formulas.

“Currently, there are about 200 types of HMOs discovered... In China, only two have been approved and more HMOs are expected to be approved in the future,” he said.

At the moment, Nestle Wyeth is one of the leading brands in China’s HMO infant formula market.

“Most major domestic Chinese companies are adding HMOs to their infant formula products, while smaller companies are coming on board as well.

“As consumer education and market promotion of HMOs increase, it will become an important feature in China’s infant formula market,” Song said.

The current state of infant formula innovation in China can be seen through three dimensions.

The first is innovation around milk lipids – like what Danone has been doing with its Aptamil products.

The second is on milk protein, and third is around HMOs.

“HMOs will become the next must have ingredient in China, this is because three types of HMOs have been approved by the China regulator, which also means that the country has a pretty high recognition of HMOs,” he added.

HMOs infant formulas already gaining market shares in China – The a2 Milk Company

New Zealand-based The a2 Milk Company is another overseas company that is seeking to capture China’s burgeoning HMO infant formula market.

It said it would be launching its HMO infant formula a2 Genesis in mainland China during the second half of the year.

This follows the launch of the product earlier this year in Hong Kong, which contains three HMOs, namely 2′-FL, 3’SL, and 6’SL, as well as GOS and the probiotic Bifidobacterium lactis HN019.

There are two reasons for the upcoming launch, said the company.

First is because HMOs use in infant formula has been approved by the China regulator.

Second, it observed that companies that have launched HMOs formulas have successfully gained market shares.

“We’ve seen some of the products that have launched in the past few years gain a lot more traction and premiumised the English label market, so that the average English label market ASP (average selling price) has grown over the past couple of years in particular, and that’s driven by some of those NPDs (new product developments) coming into market,” added Senaratne.

He was responding to analyst queries during the company’s FY25 first half results back in February.

Citing the success of Nestle and Danone’s Aptamil, he highlighted how HMOs formulas have benefitted sales.

“If you look at who’s growing their overall market share, you can see that Aptamil and Nestle are growing their overall market share, and those are the players that have been the most prolific in releasing HMO ingredient products in English label, and they’ve definitely benefited overall,” he said.

In fact, almost 30 per cent of the English label infant formulas sold in China included HMO as an ingredient, with new products taking up one to three per cent of the market share.

“It’s not just about whether it is an English label formula, but also the ingredient itself. As such, I think that the HMO containing products are gaining more share of the category overall,” added Senaratne.

Apart of its use in infant formulas, HMOs are increasingly explored for use in elderly nutrition – also a route which many Chinese infant formula companies are taking.

“The China market is now at a stage where infant formula companies are gearing towards developing functional products catered to the needs of the entire family.

“In the future, it is not just HMOs, but also other functional ingredients used in infant formulas, like lactoferrin, osteopontin (OPN), OPO (also known as sn-2 palmitate), will also be applied to elderly nutrition products,” said Song.

New research on HMOs

Based on existing scientific findings, HMOs could serve as prebiotics or foods for beneficial bacteria to feed on, as well as exhibiting anti-microbial properties.

New research by Singapore-based biotech startup AMILI will look at how HMOs could potentially support neurological, immune, and metabolic health.

The research is funded by dsm-firmenich, which has already commercialised eight types of HMOs.

Aside from AMILI, dsm-firmenich is also funding research from other parts of Asia.

An example is a study from Indonesia exploring the relationship between HMOs in breastmilk, Bifidobacterium, and vitamin D, while a study in Malaysia will assess the combined effects of HMOs and probiotics on overweight individuals.