According to the Private Label Manufacturers Association (PLMA), the top two food categories – natural cheese and dairy milk – generated record-breaking $18.9bn in combined sales in 2024, up from $17.1bn in 2023.

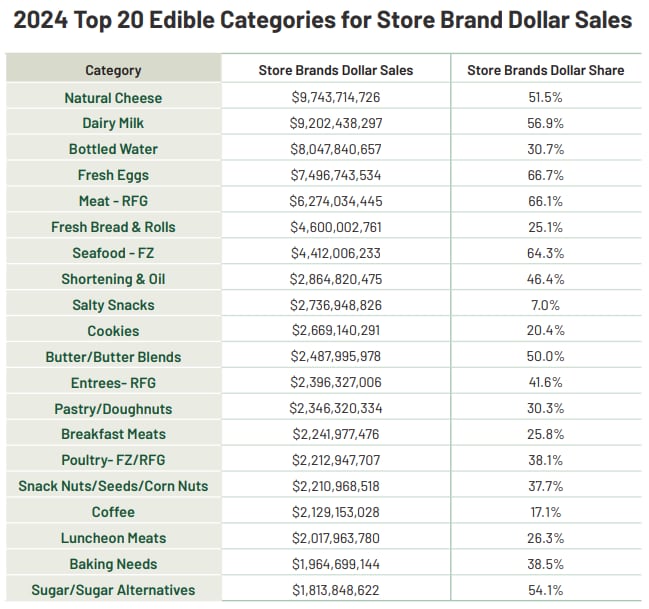

Natural cheese ($9.75bn, 51.5% store brands dollar share) and dairy milk ($9.2bn, 57% store brands dollar share) were the leading edible categories in dollar sales terms, with butter and blends ($2.48bn / 50%) 11th in the standings.

In unit sales terms, dairy milk ($2.98bn) was second only to bottled water ($2.99bn); with natural cheese ($2.87bn), yogurt ($576m) and butter ($537m) also in the top 20 edible categories.

By department, all 10 food and non-food sections finished ahead of the prior year in store brand dollar sales, per Circana Unify+/PLMA, with the two largest departments – Refrigerated (+ 7.5%) and General Food (+4.3%) – gaining the most. Beverages were up by 4%, followed by Beauty (+3.7%), Home Care (+3.4%) and Frozen (+3.3%).

In terms of total departmental store brand sales for 2024, Refrigerated was the largest ($57.7bn), followed by General Food ($51.7bn), General Merchandise ($25.5bn), Frozen ($21.6bn), Home ($18.5bn), Beverages ($14.4bn), Pet Care ($5.3bn) and Beauty ($3.8bn).

Across the board, 77% of edible own-brand categories enjoyed dollar sales gains and 71% also recorded unit sales improvement.

Why - and how - are private label sales expanding?

One reason behind private label brand’s expansion is because shoppers have an incentive to be picky, compare prices and trade down, according to Coresight’s John Mercer. “That’s partly because they remember what groceries, clothing and eating out cost them before the pandemic,” he said.

The growing gulf between upper and lower income consumer is also evident, said Chad Lusk of Alvarez & Marshal: “Households making less than $100,000 a year are more likely to pull back on spending and hold out for sales on essentials like food and cleaning supplies.”

Who's buying store brand products the most?

Young shoppers favor own-brands, according to the report.

Specifically, two thirds of Gen Z and Millennial shoppers think private labels are just as good as national brands - and a majority of all consumers say private labels play and important role in determining where they shop, according to Adweek data cited by the report.

Meanwhile, large CPG companies have been holding prices despite constrained shopper budgets, paving the way for further private label growth in 2025 – and long-term projections look even healthier.

Morgan Stanley US retail analyst Simeon Gutman explained: “We estimate private label sales growth will accelerate by 40 per cent to reach $462bn by 2030; an expansion that will redefine market dynamics significantly.

“In essence, we think the private label grocery market is on the cusp of a super cycle.”

Simeon Gutman, Morgan Stanley

“This super cycle is a by-product of COVID-era shifts in the way that customers shop and how retailers invest into this trend.

“At the same time, private label groceries reflect the rise of mega platforms, which are taking ever greater consumer wallet share and are innovating more than ever before.”

According to PLMA’s latest report, since 2021, annual store brand sales rose nearly 24%, and up 2.1% in unit sales terms.

To put that in perspective, in 2021, own-brand products generated $218bn in dollar sales terms; which grew to $270.6bn in 2024. National brands meanwhile generated $1 trillion 33.7 billion in FY24, but they grew slower, at 1% in dollar sales terms versus store brands' 3.9%.

And in unit sales terms, brands slipped -0.6% YoY whole store brands grew their share by 2.3%.