Key takeaways

- Lactalis became the leading contender to acquire Fonterra’s Mainland Group, which was up for a trade sale or an IPO.

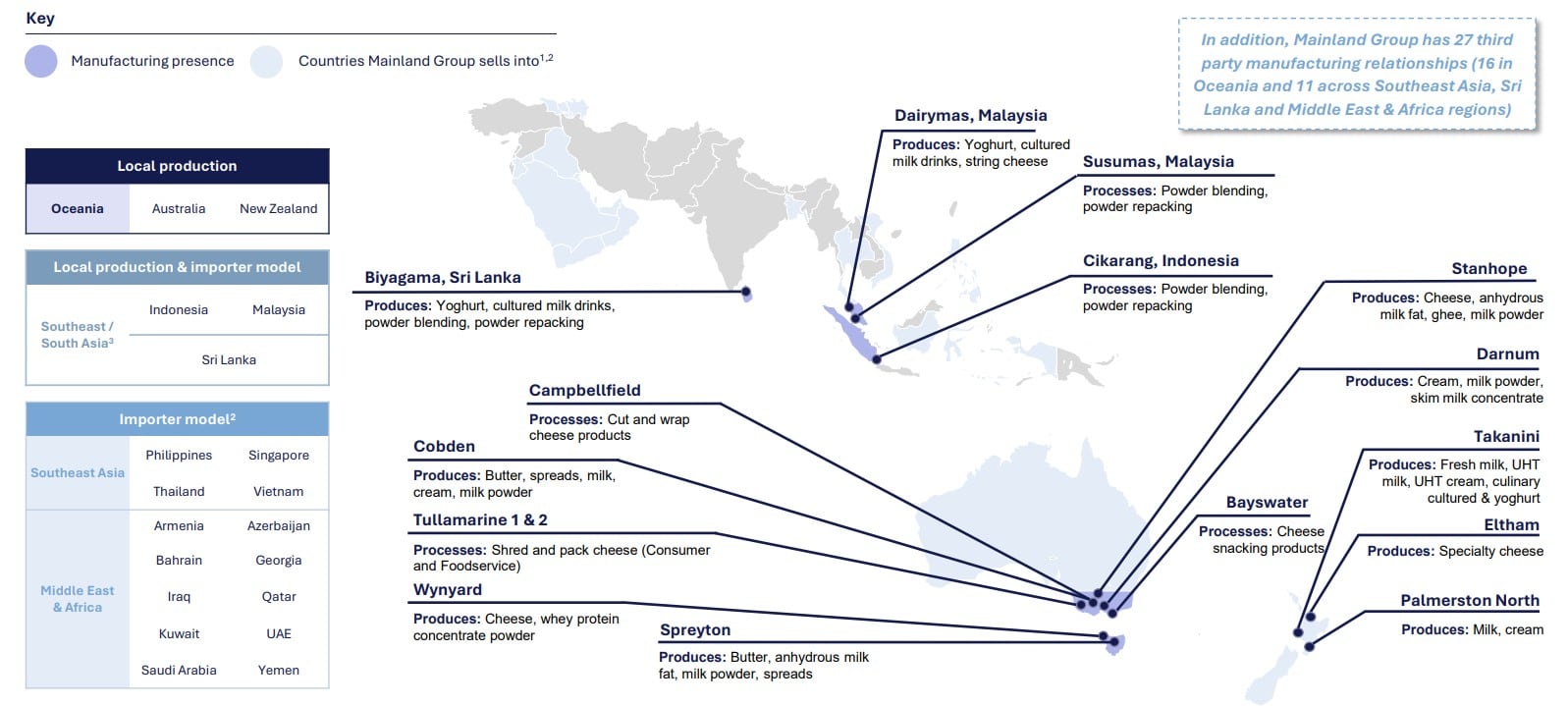

- The acquisition, valued at NZ$4.2bn in total, expands Lactalis’ geographical and portfolio diversity, enhancing its strategic position in emerging markets such as Southeast Asia and MEA.

- The acquisition includes consumer brands like Anchor and Perfect Italiano, and a significant manufacturing footprint across Australia, New Zealand, and Asia.

Once it emerged as a contender for Fonterra’s Mainland Group, Lactalis pursued a deal relentlessly.

The French multi-national – which is the world’s biggest dairy company by revenue – stood a step ahead of other potential bidders by seeking the backing of Australia’s competition regulator early on.

With a large part of Fonterra’s for-sale assets based in Australia and Lactalis among the major dairies in the region, the regulator’s informal approval of a potential deal would have greatly boosted Lactalis’ chances.

This is exactly what happened in July, when the ACCC announced it would not oppose a merger.

In early August, regional cheese player Bega also sought ACCC clearance, having tabled a joint proposal with Dutch multi-national FrieslandCampina for Mainland Group, but the duo pulled out of the race as Lactalis emerged as the highest bidder.

In late August, an agreement between Lactalis and Fonterra was announced, though the deal would only close in H1 2026 subject to multiple regulatory approvals and other customary conditions.

At a total value of NZ$4.2bn (US$2.46bn) inclusive of the Bega cheese manufacturing licenses, Lactalis is set to acquire a business that’s diversified geographically and in portfolio terms.

It’s these regions’ potential for growth that makes the deal of great strategic importance for Lactalis. The French multi-national is also adding a roster of strong consumer brands and new formats to its offering in Asia, MEA and Oceania, further strengthening its global position.

What Lactalis is getting

Fonterra’s consumer brands and integrated businesses represent more than NZ$5.6bn of net sales, according to Lactalis.

The New Zealand dairy co-op’s for-sale assets – known collectively as Mainland Group – will become part of Lactalis Australia once the deal goes through, likely in the first half of calendar 2026 now that Fonterra shareholders have approved the transaction.

Lactalis is acquiring:

- Fonterra’s global Consumer business (excluding Greater China) and Consumer brands such as Mainland, Anchor, Perfect Italiano, Western Star, Ratthi, Cheesdale, Fernleaf, Anlene, Anmum;

- the integrated Foodservice and Ingredients businesses in Oceania and Sri Lanka;

- the Middle East and Africa Foodservice business

- 15 manufacturing sites in Australia, New-Zealand, Sri-Lanka, Malaysia, Indonesia and Saudi Arabia

- 4,300 employees.

Lactalis has its own portfolio of domestic and international brands in Australia: including President, Galbani, Lemnos, Pauls, Vaalia, Tamar Valley, Harvey Fresh, Jalna, Oak and Ice Break.

The company also owns 15 manufacturing sites and has more than 2,500 employees on its books.

Tapping into growth markets

Most of Lactalis’ revenue is generated in Europe (58%) and the Americas (21%), with Asia/Oceania and Africa contributing a combined 21%. In terms of portfolio mix, the company generates 34% of its revenue from cheese; 24% – from milk, and 12% from yogurt, the remainder comprising butter, cream and powder and ingredient sales.

While developed markets like Europe and North America remain a safe bet – especially for cheese – emerging markets like Africa, the Middle East and South East Asia offer a much greater growth potential.

Investing in those regions represents a smart strategy in that sense, but also at a time when factors like changing consumption patterns, regulation, and climate change are increasingly impacting dairy production in developed markets.

According to OECD data published July 15, 2025, in Europe and North America overall per capita demand for fresh dairy products is declining, with consumption patterns shifting towards dairy fat products like cheese, whole milk and cream.

Cheese specifically is the second most-consumed dairy commodity globally – with Europe and North America consuming the most cheese, a trend set to continue in the next decade according to OECD.

Lactalis is well-established in the world’s two largest cheese markets – which is why expanding in the Asia-Pacific was seen as crucial by the French multi-national’s leadership.

Mainland Group’s product mix includes milk powder (contributing 37% of gross profits for FY24), cheese (23%), butter & cream (18%) and liquid milks (16%) and cultured dairy (5%).

Regionally, Southeast Asia contributed 24% of gross profits in the period; second only to Oceania (59%), with Sri Lanka (12%) and MEA (5%) showing steep growth.

Sri Lanka in particular is one of Asia’s fastest growing dairy markets thanks to a stabilizing economic landscape and growing tourism; while the MEA also offer opportunities in powdered milk but also cheese.

Being able to expand its footprint in those regions is likely to bring strong revenue growth and bolster Lactalis’ global influence.

Cheese brands such as Anchor, Chesdale, Mainland and Perfect Italiano are all present in those emerging markets, with a portfolio of liquid milk, powders, butter, yogurt and cream also in play.

Anchor represents a particular coup for Lactalis, given its premium positioning. Offering products in formats from liquid milk to butter, spreads, yogurt, cheese and powder, the consumer brand is Mainland Group’s best seller, generating 24% of all branded revenue.

Adult milk powder brands Anlene and Anmum also enjoy a strong presence in Southeast Asia and represent a unique proposition for Lactalis, which doesn’t own consumer powdered products in the region.

And in Oceania, Fonterra’s soon-to-be-former brands Mainland and Perfect Italiano enjoy ‘household name’ status, which would bolster Lactalis’ already strong consumer portfolio there.

The deal also comes with significant manufacturing and distribution advantages for Lactalis.

The new owner of Mainland Group will double its manufacturing footprint by adding 15 manufacturing sites in Australia, New-Zealand, Sri-Lanka, Malaysia, Indonesia and Saudi Arabia.

And that’s not all: Mainland Group has 27 third-party manufacturing relationships - 16 in Oceania and 11 across Southeast Asia, Sri Lanka and MEA.

In Australia alone, Lactalis gains a significant boost by adding five cheese processing sites across Victoria and Tasmania; with powder processing and repacking and milk, yogurt, butter and UHT dairy sites all set to come under Lactalis’ ownership.

It remains to be seen how dairy majors in the region will adapt to the new status quo.