The US is becoming a major player in the global dairy markets. To be successful, the US must be a low cost producer.

Nearly half of all US whey and nonfat dry milk is exported. Cheese is the least exported dairy commodity at 5.3%.

There is obvious room for growth.

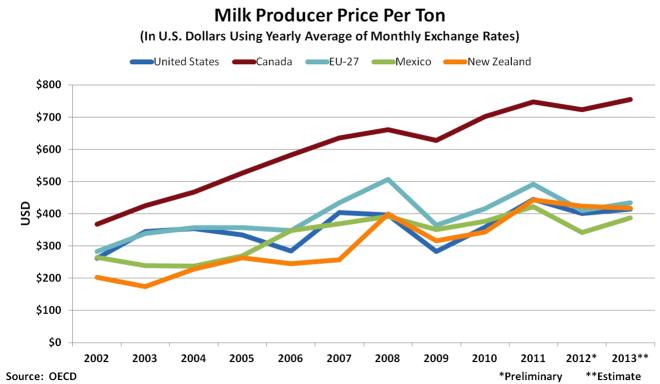

The US is a cost competitive producer. The chart below shows how the price of US milk compares to other world dairy producers.

One major difference is Canada, where the price of milk is inflated by their quota system restriction on dairy imports. With the high prices that a protective system brings, a country cannot compete in the global markets.

The global competitors for export are New Zealand, the 27 European Union (EU) Member States collectively, and for butter India is a major producer, but not a major exporter.

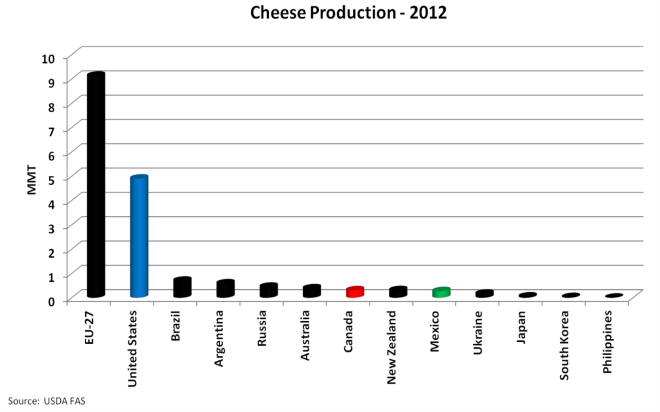

In terms of cheese exports, the US is second only to the EU.

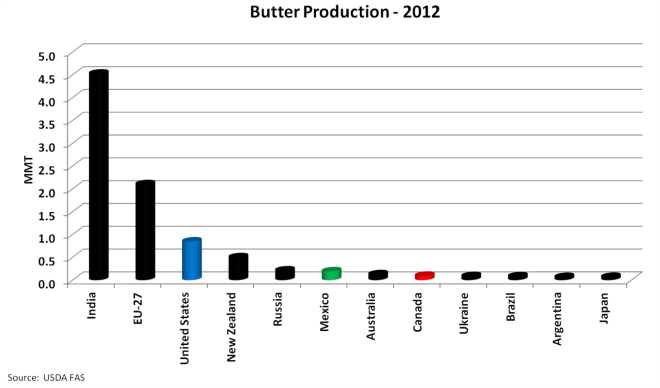

While India produces a lot of butter, almost none is exported. The major players are the EU, the US and New Zealand.

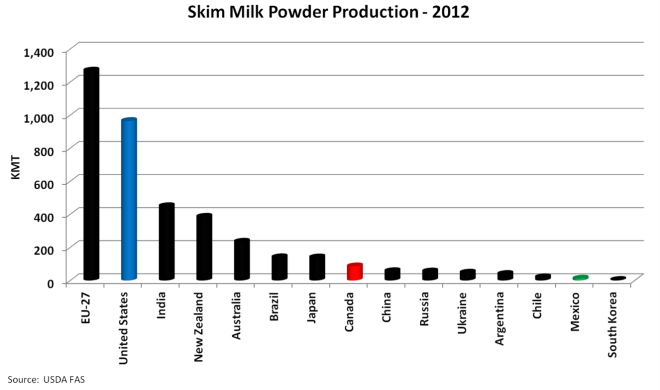

In terms of skimmed milk powder and nonfat dry milk the EU, the US, India, and New Zealand are the major producers.

Clearly, in all cases, the US dairy industry is positioned to be a major global player.

However, there are a few obstacles to overcome. One is the somatic sell count (SCC) difference between the US and Europe.

The US standard is a maximum of 750,000 cells per milliliter, while the standard for the EU, Canada, Australia and New Zealand is a maximum of 400,000 cells per milliliter. Some differences in testing and compliance exist, but the standard is clearly different.

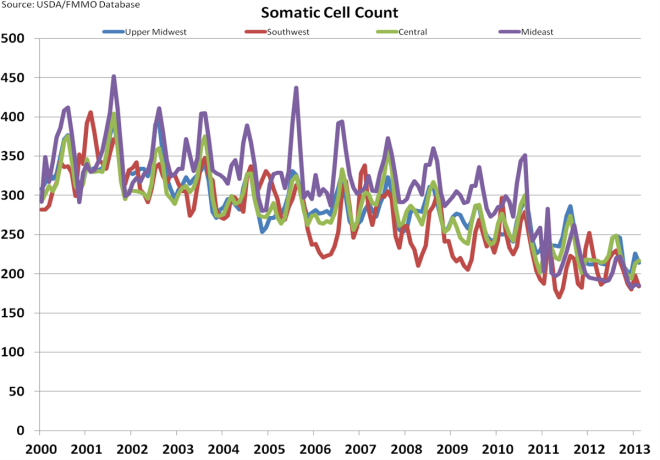

Over the last 13 years, US milk producers have significantly reduced SCC to the 200,00 to 250,000 level, as measured in the four Federal Milk Marketing Orders (FMMO) that have collected data on SCC.

There is very little justification to maintaining the 750,000 standard in the US, and it does leave the US at a disadvantage in the international markets.

The US produces and exports nonfat dry milk. The world standard is skim milk powder. The two are very similar, but not exactly the same.

Nonfat dry milk and skimmed milk powder are very similar - both are obtained by removing water from pasteurized milk and contain 5% or less moisture (by weight) and 1.5% or less milk fat (by weight).

Skimmed milk powder has a minimum protein content of 34% and nonfat dry milk has no standard for this.

While the US exports a lot of nonfat dry milk, meeting the global standard for skim milk powder would be beneficial.

US-based John Geuss is the editor of US dairy commodities blog, MilkPrice .

For the next installment of John's four part special on the US milk payment system see DairyReporter.com next week.