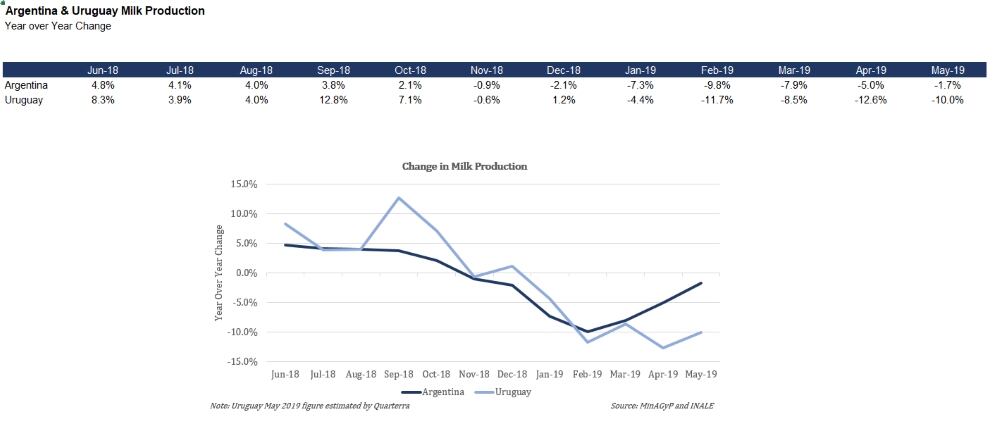

Following two particularly challenging years, 2018 was a year of volume growth in Argentina and Uruguay. For the full year, milk production in Argentina grew by 4.2% while Uruguay’s production was up by an even stronger 7.2%. The gains were chiefly driven by improved weather conditions and farm level margins that were strong enough to motivate expansion.

But while the overall annual growth figures were substantial, the majority of the increases were achieved in the first half of the year. By the end of 2018 year-over-year changes in milk production had slipped back into negative territory, setting a decidedly weaker context for the beginning of 2019.

Starting out on a weak note

So far in 2019, extreme tightness has characterized milk production in the region. Cumulative milk production is running behind prior year by 6.3% in Argentina and 9.1% in Uruguay. Insufficient milk supplies are causing significant competition between processors who are scrambling to obtain enough volume to fill their pipelines.

A few factors have contributed to the decline, with the main one being climatic issues. However, these problems have not taken shape the way they were expected to just a few months ago. South America is in the throes of an El Niño, which would typically bring very wet weather to the region. This was precisely the phenomenon that caused widespread flooding in 2016 and 2017 that pulled milk output downward.

This year, however, precipitation has been uneven, with some areas receiving excessive moisture while others exhibited near drought-like conditions. As a result, pasture quality was severely diminished and cow nutrition suffered, causing the contraction.

Of course, weather isn’t the only thing to blame. The broader Latin American economy has been lethargic with Argentina in particular suffering at the hand of high inflation and dramatic currency devaluations. These effects have bled into the agricultural sector and challenged the ability of farmers to manage their production costs and access reasonable financing.

Things are looking up

Though the complications farmers have faced so far this year are undeniable, there is reason to be optimistic about improvement in milk production in the second half of the year. Namely, while farmers have been struggling with volumes over the last few months, margins have been creeping upward to their highest levels in several years.

Milk prices are on an upward trajectory, buoyed by competition between processors. For the first time since early last year, milk prices in both Argentina and Uruguay are both sitting above US$0.30 per liter. Given processor needs, the price will likely continue to move upwards - though the gains will probably slow as the region approaches the peak production season in about October.

On the other side of the margin equation, cost of production is also moderating due to lower feed costs. A bumper crop of corn and soybeans in Brazil and Argentina is making concentrates significantly more affordable for the region’s dairymen. In some cases, dollar denominated inputs, such as fertilizers, have become more expensive with the weaker pesos. However, these increases are being more than offset by cheap grains.

All told, dairy farmers in Argentina and Uruguay are poised to enjoy stronger profits than they have in some time. These economics should encourage farmers to push forward and expand production as much as they are able, to capitalize on this fleeting opportunity. Though it may take a few months, they will surely rise to the challenge.

Impact on global markets

For the moment, weak milk production in Argentina and Uruguay has translated into limited dairy product manufacturing. What is available is being prioritized for the domestic markets, leaving less product available for exports. Processors and traders have been scrambling to keep up with orders by emptying inventories, pulling stocks down to historically low levels.

The situation will surely correct when more milk comes online, but for the moment expect that exports from the region will be suppressed. Reduced participation from these countries in global trade will create opportunities for other global suppliers to step in.

Milk production in Argentina and Uruguay has begun 2019 on a decidedly weak note. However, the aligning market dynamics should change the tides. Expect to see both countries move toward recovery in the second half of the year.

Monica Ganley is the Principal of Quarterra and the author of the Latin American Dairy Market Update. To learn more, visit www.quarterra.com or get in touch directly at monica.ganley@quarterra.com