Already, early indications are that output has begun 2020 on a positive note. However, risks are also present, which could challenge the increase in the coming months.

A challenging past…

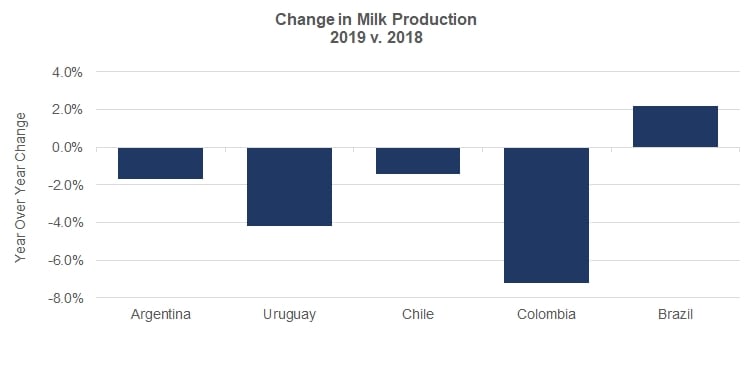

After a strong milk production year in 2018, most countries in South America witnessed volume declines in 2019.

The region’s most prominent exporters, Argentina and Uruguay, saw output shrink by 1.7% and 4.2%, respectively. On the west coast of the continent, Chile’s output fell by 1.4% while Colombia’s volumes dropped off by 7.2%.

Preliminary data indicates that milk production in Brazil grew by 2.2%, though it is important to consider that 2018 production was artificially depressed by the trucker strike which prevented milk from being picked up for ten days in May and June.

Most of last year’s declines are being blamed on inconsistent climate with pockets of too much or too little rain, which prevented good quality pasture development in many of the continent’s key dairy areas.

According to the National Oceanic and Atmospheric Association (NOAA) the El Niño phenomenon was in effect for the first two thirds of the year, sliding into a neutral pattern in the final months of 2019. By the end of the year, dry weather had become a concern across most of the continent.

…And a promising future

So far, in early 2020, things seem to have started out on a better foot. January milk production in Argentina registered an impressive year over year jump of 5.5%, meanwhile industry stakeholders in Uruguay indicate that volumes rose by about 2.0% during the month. Though official data is not yet available, similarly positive figures are expected from other regional players.

Improved moisture availability in the first weeks of the year drove these volume expansions. However, looking ahead, weather issues continue to be of concern. It has been weeks since most of South America’s dairy areas have received a good, soaking rain and forage quality is suffering as a result. It will be critical for the continent’s dairy areas to get some precipitation in the coming weeks if the trend of increasing milk production is to be continued.

Producer margins have fared reasonably well in recent weeks, though milk prices are sitting stubbornly between about $0.30 to $0.35 per liter.

Operating costs, and especially feed prices, have stayed modest, supporting farmer profitability.

However, dwindling grain inventories ahead of the South American grain harvest are beginning to place upward pressure on concentrate prices. It will be critical that farmer profitability be sustained at least at current levels for increased milk production to occur.

Demand at risk

On the demand side of the equation, South America, and especially the continent’s largest dairy consumer Brazil, have been looking forward to improved economic performance in 2020. Increased economic activity should encourage consumer confidence and in turn purchases of dairy products. However, the COVID-19 outbreak is exposing the fragility of these consumption expectations.

While the virus’ arrival to South America has been slower than in other parts of the world, significant concerns exist about the region’s ability to constrain the spread of the virus.

Furthermore, as a major commodity supplier to the rest of the world, South America will surely feel the reverberations of a global economic slowdown due to the epidemic.

Prevailing optimism

Despite the numerous risks, for the moment it appears that 2020 will be a positive year for milk production growth in South America.

Though it will be necessary for the proper climatic and profitability conditions to emerge for this to become a reality, there are many reasons to be optimistic about South America’s role in the global dairy environment this year.

Monica Ganley is the principal of Quarterra and the author of the Latin American Dairy Market Update.