It said ongoing shortages of some raw materials and supply chain disruption are also continuing to impact on availability and costs.

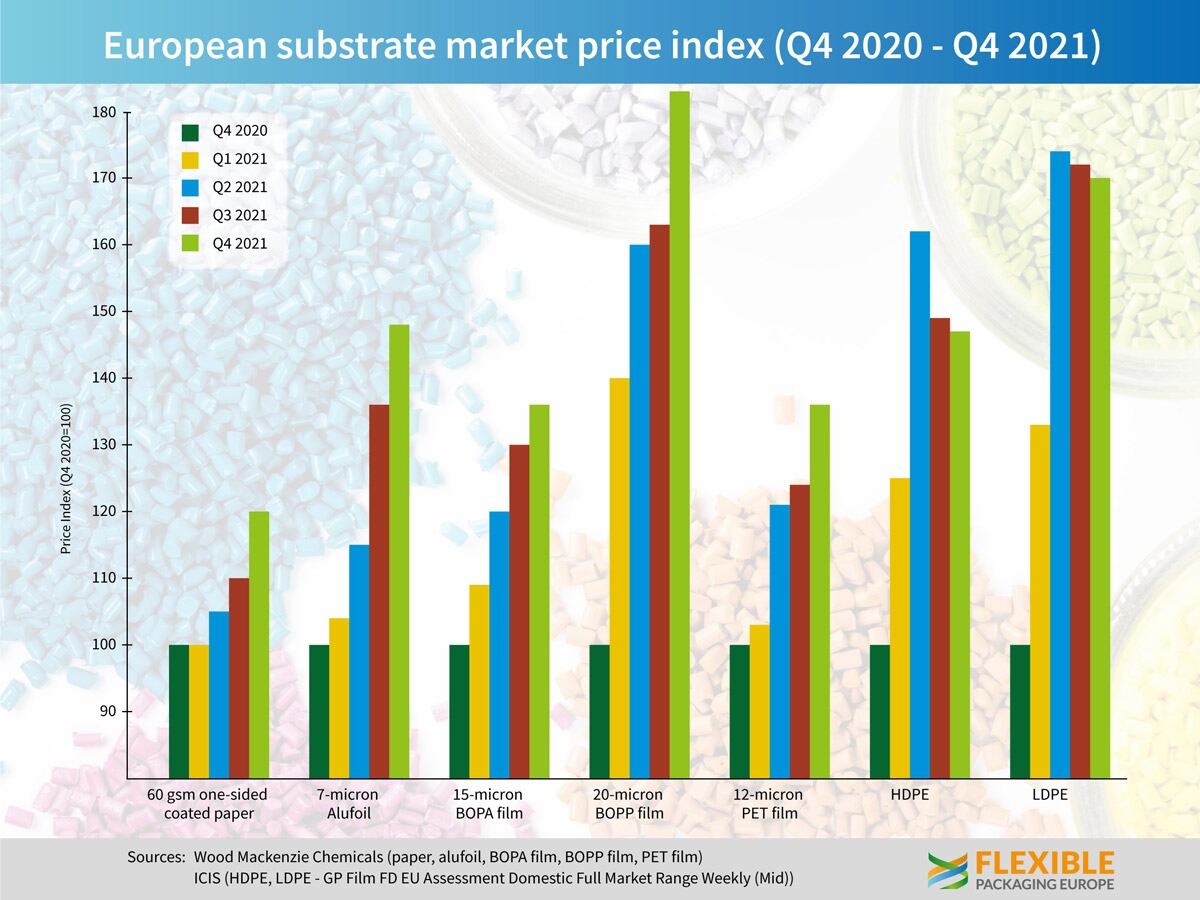

FPE said while the steep increases seen in Q2 eased slightly in Q3, the rate for 12-micron PET (+10%), 20-micron BOPP (+12%) and 7-micron aluminum foil (+9%) were all significantly up again in Q4 and ended the year at record levels compared to the end of 2020.

Twenty-micron BOPP now costs more than 80% more than one year ago, while 7-micron alufoil is up almost 50%. The 12-micron PET grade and 15-micron BOPA films are both more than 35% higher.

On a positive note, the organization said both LDPE and HDPE prices slightly fell back 2% compared to the previous three months but are still respectively 70% and 48% above the prices of Q4 2020, according to the latest figures issued by intelligence companies ICIS and Wood Mackenzie Chemicals.

David Buckby, senior analyst at Wood Mackenzie said, “A major feature of Q4 substrate price dynamics has been the contribution of rising energy costs, which began to increase at the start of 2021 and have accelerated sharply since August. To put this into perspective, energy costs in BOPP film production in Q4 were almost six times higher for some manufacturers compared to the average of the past four years, now representing almost 20% of total costs.

“The volatile environment has meant an increased preference by film and resin producers for monthly contracts rather than longer-term agreements with quarterly reviews.”

Demand continues to be strong in most markets, according to FPE, but the difficult supply chain dynamics identified earlier still apply. Volatility in oil prices and availability and cost of ancillaries, such as adhesives, inks and solvents remain problematic for the time being.

Primary production and supply of aluminum is still disrupted, and aluminum foil conversion costs have increased by approximately 50% compared to one year ago. Wood Mackenzie’s understanding is that a new round of discussions in Q4 were taking place largely for further increases to be applied in Q1.

Guido Aufdemkamp, FPE’s executive director, expressed the hope there would be improvement in 2022.

“There are some signs that aluminum production is coming back on stream and oil prices may be stabilizing. The continuing downward trend in LDPE and HDPE prices is encouraging, but prices across all flexible packaging materials remain significantly above 2020 levels. Supply chain factors should also improve in the course of 2022,” Aufdemkamp said.

“But external factors, such as spiralling energy costs due to geopolitical circumstances could easily blow off course any sustained recovery, so we remain vigilant. Flexible packaging suppliers have done very well to maintain levels of supply and delivery through the pandemic, and the membership hopes to be able to adapt to any future circumstances."