Ian Thomas, managing director of Greenfields Ingredients, the UK division of Belfast-based Greenfields Ireland, said that as soon as a market balance is achieved, prices are almost certain to start rising again.

The European Commission is already buying up skimmed milk powder through its intervention scheme, and is expected to extend this measure to butter in the next few weeks.

Opportunity exists now

Thomas told DairyReporter, “If the Commission take 100,000 tonnes of butter from the European market this spring, which we're predicting they will do, that is a new customer, essentially, for 100,000 tonnes of product.”

He said that because this takes a large amount of butter off the market, it will have an effect on prices.

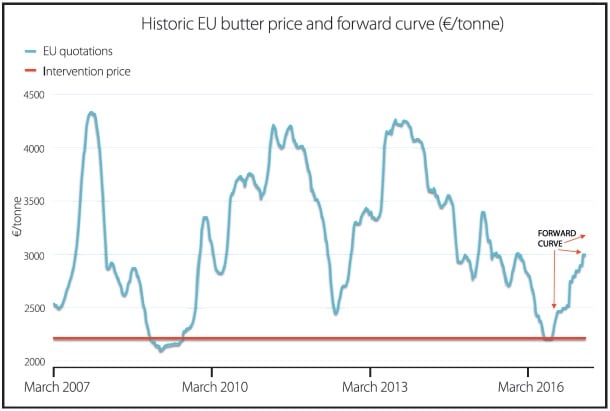

He added that with market prices for dairy commodities at a 10-year low, now is the time for food manufacturers in Europe to take advantage of a fixed-price deal for their dairy ingredients, using a long-term pricing model.

This means that for companies in the bakery, confectionery and ready meals categories, who often use large volumes of dairy ingredients, it is an opportunity that’s simply too good to miss, Thomas said.

Manufacturers already have to fix their product prices as far ahead as Christmas and Easter, Thomas noted. So when ingredient prices rise, they won’t be able to pass these costs onto consumers.

Lock in with prices low

“Our message is: there's so much uncertainty. We're in a position to be able to lock in some dairy prices at these lower levels when selling to food manufacturers, for the rest of ‘16, ‘17 and into 2018 and slightly beyond, so why, if you're a food manufacturer, wouldn't you want to lock in at what are historically low levels?”

He added, “We are particularly anxious that bakers, confectioners and ready meal producers explore our pricing models before prices start to rise again. If you've got a proportion of your volume locked in, then you can't lose. It can't go much lower.”

Range of pricing models

Greenfields Ireland has developed a range of pricing models that offer methods for food manufacturers to fix their dairy commodity prices.

“We're a long-established dairy trading business, and we have developed a range of price models precisely because of our experience in dairy commodity volatility. We know that these peaks and troughs equate to about a £2,000/tonne ($2,840) swing in butter prices, for example,” Thomas told DR.

“That's an enormous amount of money if you're a big manufacturer. You can't increase your price to your customer, and most of our customers sell to the multiples, and the multiples are very price-increase resistant.

“Considering the pressure major retailers put on their suppliers to keep a lid on raw material costs, the peace of mind this offers could prove to be invaluable.

“We're saying these are the models that are available through us, come and talk to us, we can fix your prices going forward, but you need to do it now, because if you don't that train will leave the station and prices will start marching upwards very quickly,” Thomas said.

Sustainable milk prices

The company trades in EU dairy futures on the European Energy Exchange (EEX), the Chicago Mercantile Exchange (CME) and the New Zealand Exchange (NZX), which Thomas says gives it the ability to hedge dairy commodities to the benefit of its customers.

This approach is combined with sustainable milk price contracts for Greenfield’s farmers, which typically extend over three to five years.

Thomas says this gives its suppliers more certainty over selling prices, ensuring its supply chain is sheltered from excessive risk.