The company explained it is witnessing an hour-glass effect, with strong sales of big-ticket items in general merchandise but a drop off in everyday essential categories like dairy, where struggling consumers are trading down to manage inflationary pressures.

“We serve a wide range of customers and certainly have seen strength in the consumer. We see growth in high-ticket items like game consoles recently with warmer weather, strength in patio furniture, grills, gardening, and hard lines, but we do see some consumers switching we see categories like Deli, lunch meat, bacon, dairy, where we see customers trading from brands to private brands,” Walmart US President and CEO John Furner commented.

The company – often viewed as a bellweather of economic robustness in the US – missed first quarter earnings expectations last week, when it raised its sales outlook for the year but lowered profit forecasts. First quarter sales increased 2.4% in the period, but operating income decreased 23% in the period. Given US inflation, which is at its highest for around four decades, Walmart lifted its full-year sales expectations to 4%, up from the previous 3% projection. However, the profit outlook was lowered from mid-single-digit growth to a decrease of up to around 1%.

Food inflation hitting low-income families

Last month, US food inflation reached its highest level since 1981, rising 9.4%.

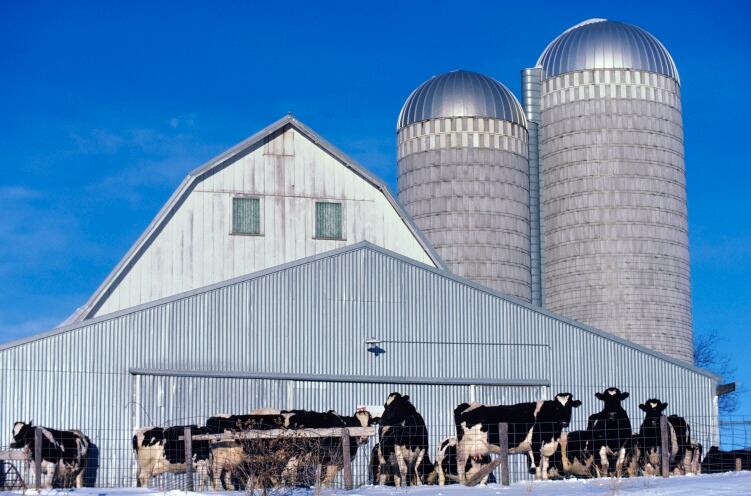

Speaking to analysts during a conference call, Wal-Mart management noted that consumers who are feeling the pinch are trading down in ‘essential’ food categories, including dairy.

“In proteins and dairy we see some switching from brands to private brands. And we see switching from gallons of milk to half gallons of milk. We've got to do what we can in those categories to keep costs low,” Walmart President and CEO Doug McMillon insisted.

In an environment where food inflation is moving up, McMillon said the company wants ‘customers to have lower prices’.

“Not all of [our customers] can afford to absorb this. That's where they need our help. And so we do stay focused on opening price point food items. A loaf of bread, a gallon of milk, a can of tuna, mac and cheese, protein categories. Are we helping a family that's at the lower end of the income scale, be able to afford to feed their families during this inflationary time?”

‘We need to do more to help customers out’... Wal-Mart wants suppliers to tackle prices

US CEO Furner insisted that Walmart’s procurement teams and suppliers ‘need to do more to help customers out’ and address spiking prices on shelf.

“Our team and our suppliers need to do everything we can do to keep costs low so that we can have values for customers that are meaningful. That's the purpose of the company,” he stressed.

“My team specifically in our supply base, we need to do more to control costs to ensure that we can provide great value in retail for our customers. I mentioned a group of categories in proteins and dairy, where we definitely see switching as we look at what's happening in the baskets. So I think we have some work to do in terms of ensuring that we're providing the right values, and we're going to do that across the second quarter going into the rest of the year.

“We've got to make sure we're doing everything we can with our suppliers to manage our costs so that we can keep food pricing in a great spot for our consumers. We think about our price gaps every day. We talk about it every day, every week, and we manage those carefully. And what we need to do is work together with our supply base in categories like we mentioned, in proteins and dairy, where we see some switching from brands to private brands and from gallons of milk to half gallons of milk. We've got to do what we can in those categories to keep costs low.”

But what about rising input cost inflation?

While this low-cost focus might be welcome news to low-income families in the US, it could well sound some warning bells for dairy suppliers who are already struggling with input cost inflation.

According to a recent report from Rabobank, high milk supplies in the US have depressed prices in the market, meaning that they already haven’t been keeping up with increasing input costs.

Feed costs are generally higher without much hope on the horizon for a turnaround, said the analysts on last year’s harvest.

“Drought-stricken corn crop conditions in the US are bleak and keeping [feed] prices elevated. Brazil’s safrinha crop failure will provide no relief to global markets. US soybean yields are also expected to disappoint,” noted the Rabobank team.

In fact, Barclays analyst Andrew Lazar said that he views continued price increases from food manufacturers as warranted given the cost inflation that they face. After the stern update on pricing issued by Walmart, the food analyst met with manufacturers to get their take on the pricing window.

"Each of the companies we met with talked of quite a bit more inflation coming and, in our view, this will require incremental pricing on top of what has already been taken," Lazar suggested.

"To be clear, we can certainly see why list price increases become progressively more difficult the more rounds that get taken, and would look for incremental actions to be more strategic and targeted than the wholesale across the board increases of the first several rounds," he wrote in a note to investors.

Nevertheless, Lazar continued: "We’d think it unlikely that food manufacturers would ultimately be forced to bear the full brunt of this pressure. Notably, we are not talking about modest inflation here that can be addressed with ongoing productivity savings (as opposed to pricing) as was the case prior to this inflationary cycle. The reality is that more pricing is justified, in our view, and food companies are still under-recovering and in the mode of trying to catch up to past inflation – as can be seen by the several hundred basis points of gross margin contraction for most food names."