Dairy producers’ milk prices have tumbled from their lofty 2022 levels while their cows digest new crop feeds and forages priced at record highs.

Expensive input costs remain a clear headwind worldwide and combined with lower milk prices result in farm-level margin pressure. In response, dairy cow slaughter rates have escalated, reads the bank’s Q1 2023 global dairy quarterly.

Geopolitical unrest

Geopolitical unrest continues to cloud supply and demand estimates. The intensifying Russia-Ukraine war increases the risk of higher feed costs around the globe for a second year, through rising farm input costs, said the team.

An escalation in trade tensions with China would have negative repercussions on global dairy markets due to its dominance in dairy imports.

And the macroeconomic environment remains complex, noted the analysts. "Inflation has slowed, but primarily due to falling energy prices. Core services inflation remains strong. The labor market is still very tight in certain sectors, and the central banks continue to raise rates. There are increased signs of a slowdown in household consumption, which is likely to continue deteriorating over the coming months."

Modest milk production growth

Rabobank does expect milk production from the Big 7 export regions to grow in 2023, but by 0.7% year-on-year. The analysts downgraded their 2023 forecast from last quarter’s estimate of 1%.

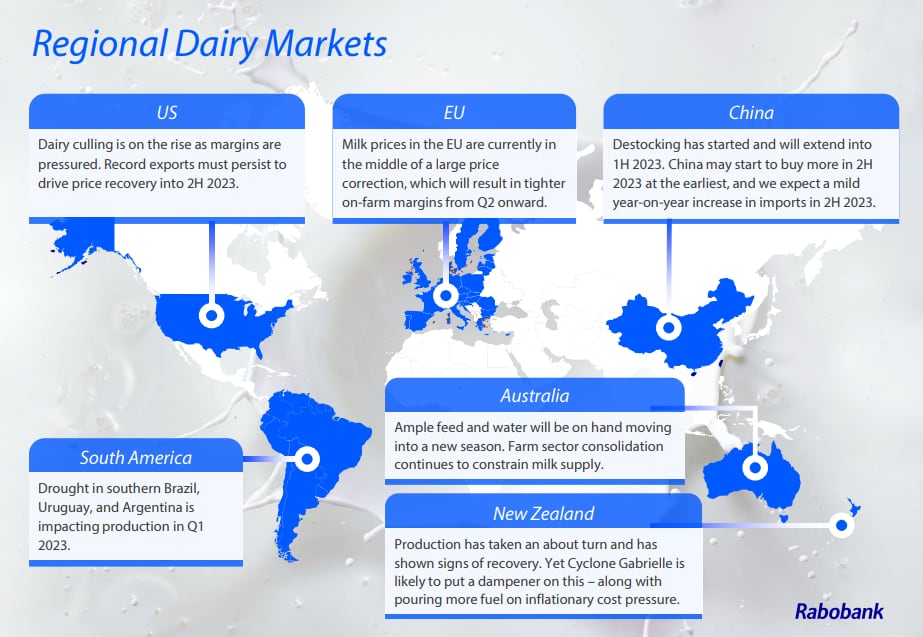

“This slower growth is attributed to increased culling in the US and weather-related production challenges in New Zealand, Brazil, and Argentina,” said Mary Ledman, global sector strategist for dairy at Rabobank.

Much depends on internal Chinese policies and broader demand resilience to support dairy product prices in 2023, she added. “China’s dairy imports in the first quarter of 2023 are expected to fall short of year-ago levels, with renewed buying interest developing in the second quarter of the year. We expect a mild year-on-year increase in imports in the second half of 2023.”

Feed costs

In the US, from a feed cost perspective, corn, soymeal, and alfalfa hay values remain elevated. “As in 2022, feed costs are well above the average rates seen over the past decade. There is limited near-term downside expected in feed costs, keeping the cost of production high this year and causing tight margins at current milk prices.”

Looking to the New Zealand market and the analysts say fuel and fertilizer costs, followed by feed costs, are proving headaches for dairy producers there. “However, the worm has turned downward for benchmark fertilizer costs, providing some optimism for input price relief over the coming months.”

Many dairy farmers in Australia will enter autumn with good feed reserves and the availability of irrigation water and supplementary feed, after a decent 2022/23 winter crop, as preparation begins for next season, according to the outlook. There are supply and quality issues with fodder, and purchased feed remains pricey. Fertilizer prices are heading back to more normal farmgate price levels.

The intense drought of late 2022 and early 2023 in Argentina has continued impacting forage availability in many regions and will make profitability more challenging during Q2 and Q3, as dependence on grains for feed will rise, forecast the team.

In China, Rabobank anticipates soymeal, alfalfa, and cottonseed costs will stay high.