While inflation may be easing across the globe, consumers are still feeling the pinch with their day-to-day expenses – especially as food and beverage prices remain 50% higher than they were in 2019.

Despite the belt tightening, the health movement is still trending and 67% of global consumers cite health and wellbeing as their top priority.

However, four in 10 find health and wellbeing nutritional products too expensive. New Zealand dairy major Fonterra’s wellness brand Nutiani also found one in three say the inflationary environment has made it hard to continue purchasing the oft more expensive, better-for-you products.

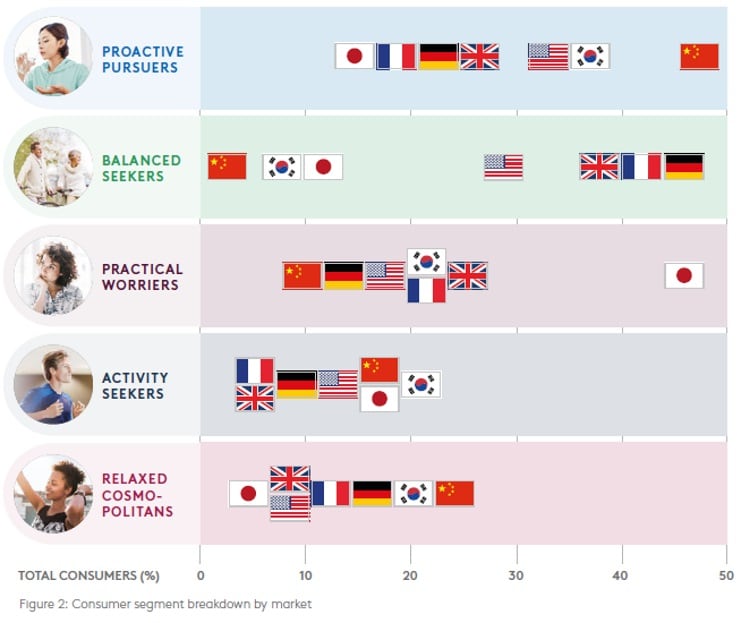

Wanting to understand the current state of play, Nutiani revisited its June 2023 Consumer Health and Nutrition Index conducted in collaboration with IPSOS, which surveyed 2,500 consumers across the UK, the US, China, Japan and South Korea. The brand’s Health, Nutrition and Rising Costs report – the first of a series for 2024 – also tapped its Consumer Segmentation Research from 2022 and expanded on its Top 10 Health and Nutrition Trends for 2024 released earlier this year.

What does value mean to the consumer?

Underscoring the results is a prerequisite for value-creating innovation by the brands navigating this challenging landscape.

“For brands to thrive in today’s dynamic market landscape, they must pivot towards inflation-resilient strategies,” said Komal Mistry-Mehta, chief innovation and brand officer at Fonterra.

“But it doesn’t stop there. This innovation must resonate deeply, creating a meaningful, positive impact on consumers. The future belongs to brands that understand this and adapt accordingly.”

More consumers are taking proactive steps to manage their health, with eight in 10 believing that nutrition is key in enhancing wellness and preventing illnesses. However, many are adjusting their approach to nutrition to suit their pockets.

Budgeting more conscientiously means mindful consumers are not focused merely on prices but the holistic value the product promises to deliver. Dictated by the adage of ‘quality over quantity’, that means affordable alternatives that are a cut above the rest in sporting effective, science-backed ingredients.

This begins with a better understanding of what value entails. Though a product’s value is typically equated with its price, its true value actually encompasses all the benefits it offers at its price point.

To define this, Nutiani’s research broke down four key value-drivers that will give brands a better chance of appealing to consumers in the current climate.

“Even with the tightening of purse strings, we continue to see bright spots in the wellbeing nutrition space as this will remain top of mind for consumers,” said Mistry-Mehta.

“For instance, 65% of consumers surveyed plan to make dietary changes to improve their health and wellbeing over the next year, which is a three percentage point increase over the last survey in 2021. There is a massive opportunity here for brands to tap on this demand by staying tuned to rapidly evolving consumer preferences in the current market.”

The highs and lows of creating value

Using an extensive compilation of consumer insights, industry case studies and expert opinions, the report explore four themes to guide brands.

Relevance: Unveiling the top consumer priorities

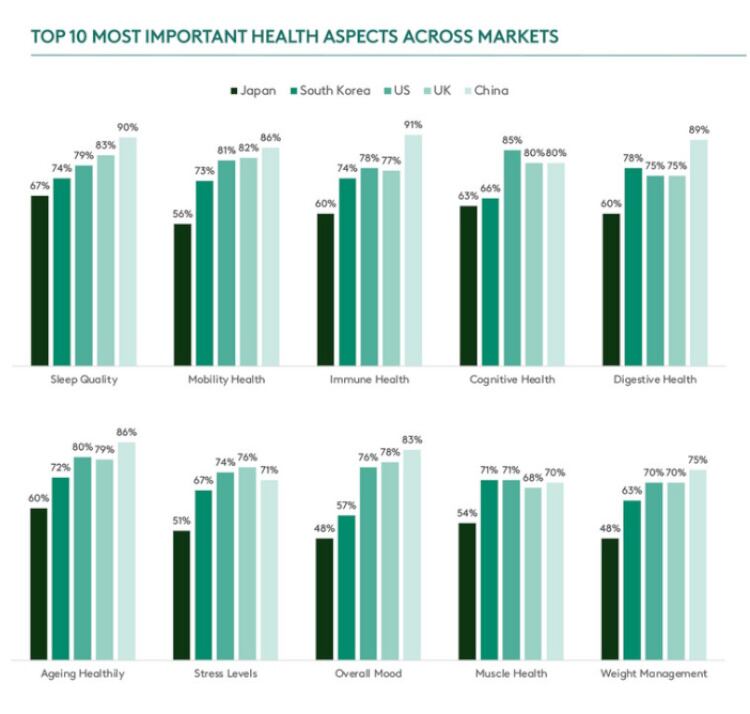

Consumers have recognised that health goes beyond physical fitness, with 36% prioritizing mental health, 27% their mobility and another 27% saying being rarely ill or suffering from a physical ailment is the definition of health.

According to Nutiani’s report, half of those consumers still buy what they consider essential products, but nearly a quarter are buying fewer high-quality products to manage costs.

But there’s a downside. This cohort of consumers is consciously cutting back on impulsive purchases and niceties like snacks, says the brand.

As such, targeted solutions are crucial, with sleep quality (78%), immunity (76%) and mobility (76%) being the main concerns.

Nutiani’s go-to-market tip: Brands must develop tailored products with specific functional ingredients that have a very clear value proposition. This will help them forge a meaningful connection with their audience and elevate the perceived value of their proposition – a strategy that will be the differentiator that ensures loyalty.

“For brands seeking to remain at the forefront, the key lies in crafting solutions tailored precisely to consumers’ paramount concerns,” said Angela Rowan, head of Innovation, Advanced Nutrition, Fonterra.

“Nutiani’s robust portfolio of wellbeing ingredients is developed to e leveraged for holistic solutions that meet consumers’ desired health outcomes.”

Science: Empowering consumer confidence

In today’s vast sea of information, health claims substantiated by credible clinical trials will be the differentiator.

In fact, Nutiani’s research found 62% of consumers – most notably Chinese respondents – say scientifically proven ingredients and evidence of efficacy impacts their trust, while 56% seek out certifications from reputable sources or public endorsements.

This means randomized, double-blind, placebo-controlled studies conducted on the product itself (or an ingredient if other conditions are met); carried out on a population that matches the product’s target audience. Obviously, results demonstrate statistically significant results compared to the placebo sample and identify a benefit that is clinically meaningful.

The downside: This dedication to scientific validation may translate to a premium price, but Nutiani’s go-to-market tip notes that it also promises unparalleled quality and trustworthiness and creates some margin for brands to pass on costs.

Convenience: Unlocking value in one-stop resources

While the intention is high, many consumers flounder in maintaining their health journey, noting its too expensive, its difficult to follow a stringent daily plan or its bland and not tasty.

Tackling health management often feels like navigating a maze, with busy individuals finding it daunting to juggle a complex, multi-step routine.

Enter value-add through multifunctionality. With 19% of Nutiani’s survey respondents emphasizing the importance of convenience, products that empower consumers to make the most of their time and resources will win.

Breaking it down, Nutianti’s research found adapting to consumers’ preferred formats also ensures seamless integration into their daily routine. In China, for example, consumers lean towards protein drinks for muscle health and physical activity; in the US, a juice or smoothie is associated with weight management and chocolate is seen as a good vehicle for stress management; and spoonable yogurts can deliver digestive and immunity benefits.

But clarity is vital – especially in today’s environment where consumers are constantly battered with an abundance of conflicting nutritional advice.

Experience: Elevating the experience

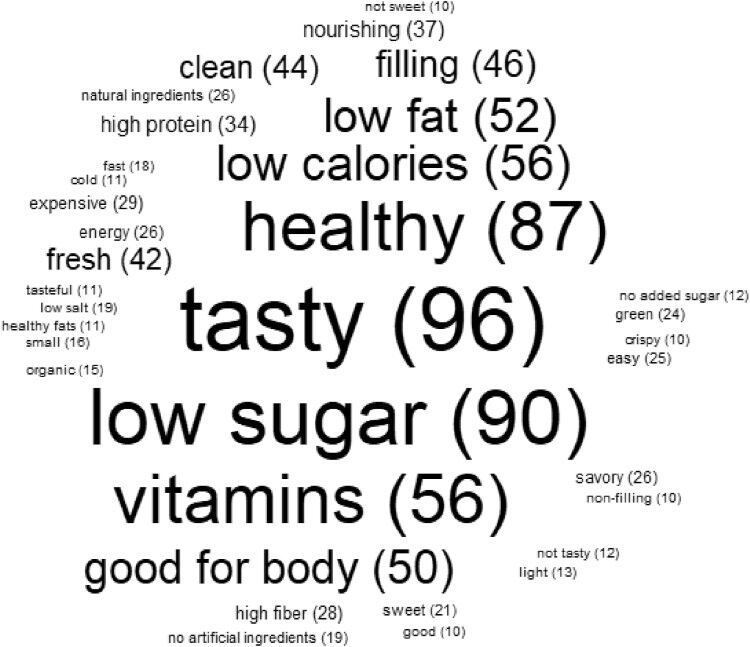

Taste is just a preference: it’s what differentiates a successful brand from one that remains on the shelf. In fact, as above, it’s one of the three biggest challenges in maintaining a diet.

Recent studies indicate that sensations – including taste – can alter emotions and mental health is pivotal in overall wellbeing.

And good news for snack developers, Nutiani’s research found that snacks play an important role here: with 38% of consumers snacking to relax and 36% finding hat snacking boosts their mood. Of the markets surveyed, Japan has the highest percentage of consumers (57%) who snack to relax.

Nutiani's go-to-market tip: Explore, explore, explore. To appeal to a wider audience, brands must explore new flavors, formats, aromas and textures. Crunchiness, for example, may appeal to consumers seeking comfort during a stressful time. It also denotes food freshness.

“With more consumers interested in nutritional solutions but less willing to compromise on taste and textures, there is a huge opportunity to increase engagement by enhancing the nutritional profile, and hence healthfulness, of everyday foods, including treats,” said Rachel Marshall, technical engagement manager, Advanced Nutrition, Fonterra.

“As brands innovate, they must remember: If the product does not taste good, customers will not repeat their purchase.”

But why stop there?

Nutiani further advises brands to engage with consumers by exploring webinars, provide budget-friendly diet guidelines and nutritional tips from certified dietitians and even connect through fitness classes and community stories.

“The right inflation-resilient strategies and value-based innovation that resonate deeply are the keys to success in these challenging times,” said Mistry-Mehta.

“If brands can create a meaningful connection with consumers now, they will be able to stay ahead of the curve and retain engagement with their customers beyond this period.”