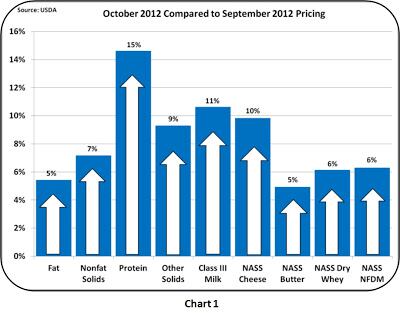

October Class and Components Milk Prices were announced on November 1st. The increases met all expectations with significant increases in all parameters, especially the most important one, protein.

Milk protein increased $0.48/lb as cheese prices increased 10% and butter prices increased a smaller 5%.

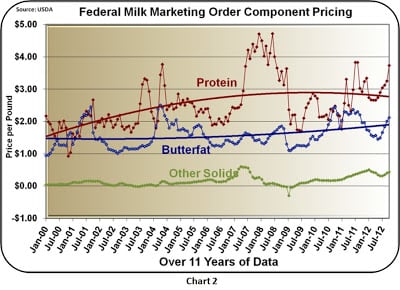

Chart 2 illustrates the magnitude of the protein increase.

Milk protein reached exceptional highs in 2008, driven by unusually huge exports. Exchange rates are again impacting exports and keeping demand high.

Currently there is a big difference because, in addition to favorable exchange rates, export programs that will have a long term impact are also driving higher exports.

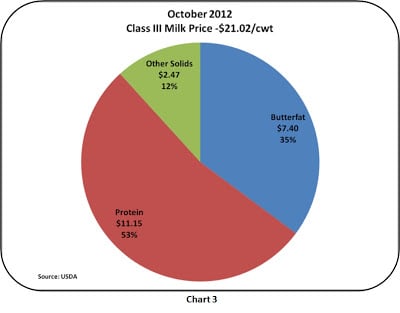

Milk protein made up 53% of the milk check in October (Chart 3). Clearly, a producer trying to maximize revenue must do everything he can to maximize protein volume from his cows.

An increase of 0.1 lbs of milk protein per cow per day will increase revenue by $0.37 per cow per day. For a producer with 1000 lactating cows, this represents additional revenue of $135,000 per year.

Although milk protein and cheese are the big news, in the sections below, "Other Solids" will be analyzed first. Other Solids prices are based on the dry whey price.

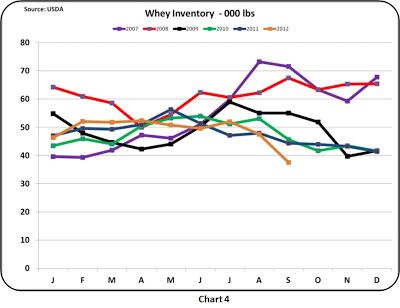

While inventories are low, causing the higher prices for dry whey, the production of dry whey cannot react to this shortage because the availability of dry whey is totally dependent on cheese demand.

Dry whey is the by-product or maybe the co-product of cheese manufacturing, but no one makes cheese just to get the whey. The demand for cheese drives the availability of whey.

Other solids

Inventories of dry whey are at six year lows. Demand is far outstripping supply. There is very little reason to expect this to change.

Whey as a co-product of cheese manufacturing is a food grade product with relatively high protein (the non-casein proteins that do not remain in cheese pass on to the whey).

There is a high lactose content that gives whey a very sweet taste. Typically it is low priced. All these factors make whey an attractive product for use in human foods and animal feed.

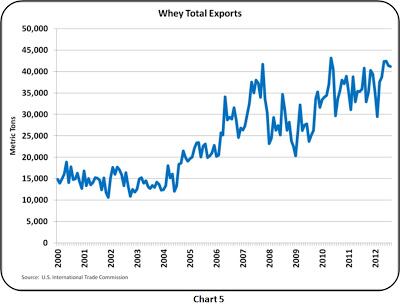

Whey exports (Chart 5) remain at record levels. These exports have more than doubled over the last 10 years.

Typically, Other Solids have not been much of a factor in the Class III Milk Price, but this may be a long term positive change. In October, Other Solids made up 12% of the milk check or $2.47 per cwt of milk.

For part two of John's monthly commodities update and a look ahead to November, visit www.dairyreporter.com on Monday 5 November 2012.

You can see John's month-to-month dairy commodities breakdown at his blog, MilkPrice.