US COMMODITIES CORNER

November prices remain high, but cheese suffers 'unusual' drop - Part Two

Whey exports remain high helping to keep the 'other solids' price high.

Because whey is a by-product (or co-product) of cheese production, the available volume of dry whey is determined by the amount of cheese produced.

The amount of whey produced is nearly equal to the amount of cheese produced on a solids basis. At the current time, 40,000 metric tons of whey are being exported every month. By comparison, there is about 20,000 metric tons of cheese exported, which on a dry basis would amount to about 12,000 metric tons of cheese solids.

The disappearance of dry whey is clearly driven by exports.

This has created an increasingly tight supply of dry whey. As stocks are depleted, the laws of supply and demand result in increased prices.

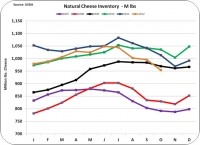

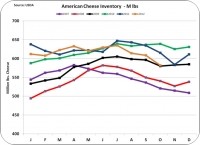

Cheese

Cheese prices as reported by NASS are currently high at over $2 per pound (lb), but they are falling rapidly. The cheese price is the most important parameter for Class III milk pricing. The November NASS price for cheese was $2.01 per lb. By comparison, the December 7 price for barrel cheese on the CME is $1.66 per lb and block cheese is $1.76 per lb.

This would indicate that NASS prices may fall by 15% in the month of December. CME cash prices for cheese lead the NASS prices by about two weeks.

The drop in cheese prices is unusual considering the relatively tight inventories reported for October.

Cheese production remains consistent with long term trends, and exports remain well above prior year levels. Because the reporting of cheese inventories and exports lag, this analysis lacks current data, but as of the most recently reported data, there is nothing that should be driving down cheese prices as much as is currently happening.

The drop in cheese prices currently occurring seems to be inconsistent with other data, so it may be short lived. However, for now it is real and future Class III milk prices are dropping below $19 per hundredweight (cwt) reflecting the lower cheese prices.

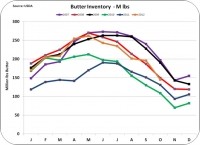

Butter

Butter prices calculated by NASS were $1.84 per lb for November.

Current CME cash prices are at $1.61 per lb or 13% below the reported NASS prices. Although butter prices have a lesser impact on Class III milk prices than cheese, this would also suggest that December milk prices will be well below October and November prices.

This price decline is also unusual as butter stocks remains at reasonable levels.

Where are milk prices going?

Class III milk prices are headed for their own fiscal cliff beginning in December.

The futures prices show a continuation of lower Class III milk prices beyond December. However, because exchange rates remain favorable and inventories for cheese, butter and dry whey are not high, it seems reasonable that the drop in future Class III milk prices that exist at the present time may moderate or at least not deteriorate further.

You can see John's month-to-month US dairy commodity breakdowns at his blog, MilkPrice.