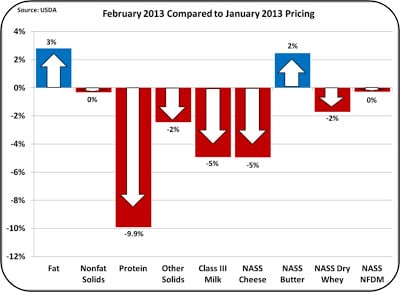

Class and Component prices for February were announced on February 27. The Class III price fell to $17.25 per hundredweight (cwt) from the prior month's price of $18.14 per cwt, a 5% drop.

The Class III price is strongly related to the cheese price which also fell 5%. Milk Protein fell 9.9% because cheese prices fell 5% and butter prices rose 3%.

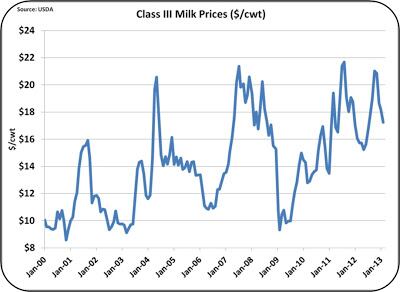

Current and futures prices for Class III milk are all in the $17 per cwt range.

How bad is this? By historical standards, it is not so bad. As compared to the highs of $20 per cwt, $17 seems like quite a drop. But, compared to pricing over the last 12 years, current prices are reasonably healthy.

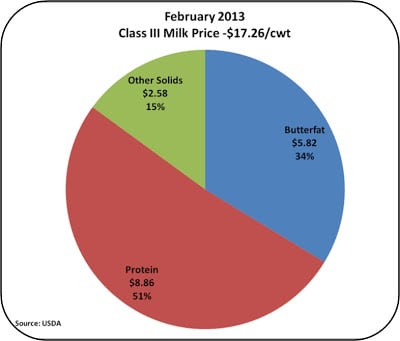

The most valuable part of milk is the protein. The cost of feeds has certainly made profitability a challenge at $17 per cwt, but current prices are OK from a historical perspective.

Payment for protein at the USDA standard level of 3%, made up 51% of the milk check. If protein percent were higher, the payment would be greater.

The key to maximizing the milk check is to maximize milk protein. Every 0.1% increase in milk protein is worth an additional $0.33 per cwt, while every 0.1% change in milk fat is worth $0.16 per cwt.

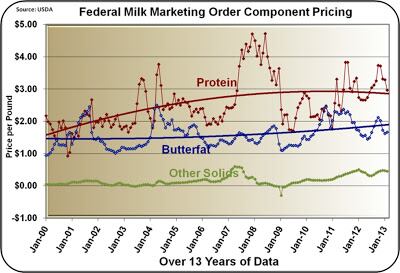

Chart 4 (below, right) shows the 13 year trends for milk protein, milk fat, and Other Solids. Other solids pricing was stable at $.45 per pound (lb), the new normal.

Cheese prices remain the primary driver of Class III milk prices. Domestic consumption of cheese increases steadily and is very predictable.

However, cheese exports are not so predictable. They are influenced by many factors in the world market for cheeses.

For part two of John's monthly commodities update, including an analysis of US cheese exports compared to other major dairy producing countries, visit www.dairyreporter.com tomorrow (Wednesday 6 March 2013).

You can also see John's month-to-month dairy commodities breakdown at his blog, MilkPrice.