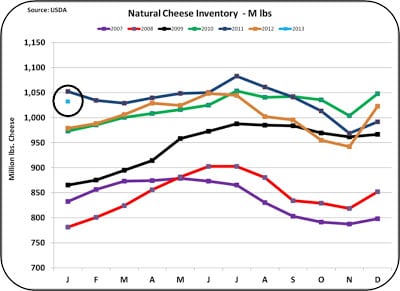

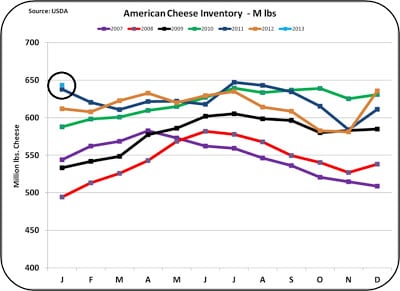

Cheese inventories remained near record highs at the end of January 2013 (see the circled values left).

The high inventory levels came about sharply at the end of 2012 and continue to remain high. These stocks must be depleted before milk prices can improve.

The major culprit for the increase is exports that will be analyzed in some detail to the right.

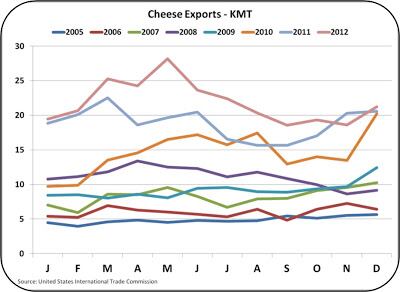

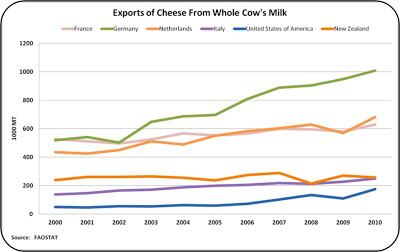

December 2012 cheese exports were a record for the month of December. December 2012 is the most recent export data available.

However, December exports were down nearly 25% from their May high. There is no cyclical pattern to cheese exports, so the decrease is not a normal annual rhythm.

It is a decrease caused by adverse business conditions in the global markets.

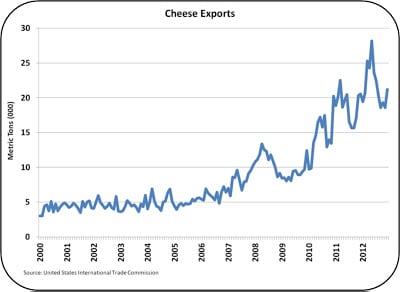

The chart to the right expresses the same export data in a continuous form, so the increases in exports over the last 5 years are more visible. The U.S. has made very nice progress in expanding exports of cheese and there is a significant opportunity to grow exports much further.

The growth has occurred in an up and down pattern of volatility. From May to September, the largest drop in the history of cheese exports occurred. No wonder cheese inventories are bloated.

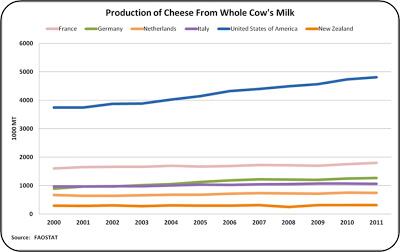

The U.S. is the largest and fastest growing cheese manufacturer in the world.

There is no other country that is even close to the U.S. in tons of cheese manufactured. Well over 90% of this is consumed domestically.

However, domestic consumption is still well below that of the Eastern European countries, so additional increases in domestic consumption can be expected.

However, as compared to other dairy exporting countries, the U.S. is far behind in exports.

Data for the chart below is available only through 2010, but even with the U.S. growth in 2011 and 2012, the U.S. is still not getting the volume of cheese exports that it should achieve on the world market.

Exports of cheese are made up of commodity cheeses and specialty manufactured and branded cheeses. The latter category is more profitable and less price sensitive to world events.

Commodity cheeses (eg. blocks or barrels of cheddar cheese) are more subject to volatility because the same cheese is manufactured in other parts of the world and all sources must compete on a price basis.

With changes in exchange rates as well as global swings in milk production and consumer demand, exports of commodity cheeses are very volatile. The large U.S. exports of commodity cheeses leaves the U.S. open to significant volatility.

For part three of John's monthly commodities update, including a look ahead to March 2013, visit www.dairyreporter.com on Friday 8 March 2013.

You can also see John's month-to-month dairy commodities breakdown at his blog,MilkPrice.