China infant formula demand: Product shortages continue in Australia despite increased production

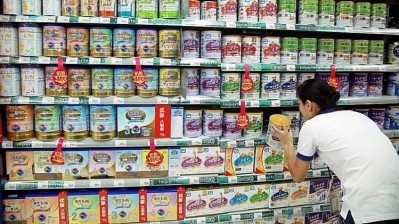

Daigou shoppers, who buy commodities overseas to sell in China, are snapping up tins of formula in bulk, a trend that threatens to change how the product is sold in Australia, according to data and analytics firm GlobalData.

These products are sold in China via apps such as WeChat, and parents are willing to pay up to five times the retail price for formula they are confident is safe for their children to consume. Australian media recently reported that 1kg tins of formula selling for up to A$35 each in local stores were resold in China for approximately A$100 per tin.

This willingness to pay exorbitant prices for formula is due mainly to the numerous food safety scandals that have dogged China in the past — particularly the 2008 melamine milk scandal that killed six babies and put around 54,000 others in the hospital.

At the same time, China's penchant for food fraud adds to the public's distrust of even 'branded' overseas products — authorities recently seized over A$6.3m in counterfeit goods, including food and supplements.

Seeing double

Some manufacturers have responded to this surge in demand by increasing their production of infant formula.

For instance, Danone has doubled its production capacity at its New Zealand factory, with most of its formula meant for Aussie supermarkets. Production of The a2 Milk Company’s premium formula has also doubled.

In fact, overall production of Australian-made infant formula has doubled in the past year, but GlobalData believes this is unlikely to make things easier for local buyers.

A spokesperson from the Infant Nutrition Council (INC, representing the industry in both Australia and New Zealand) told NutraIngredients-Asia: "Manufacturers have increased production, but product quality and safety is the highest priority, and they will not compromise their rigorous production standards."

The INC also suggested an alternative route for parents dealing with shortages: "All companies affected have online sales and care lines, and consumers can contact them directly to get the infant formula brand they want."

It added that the industry is highly regulated, as infant formula is a "vital sole source of nutrition" for babies who are not breastfed.

"For this reason, companies are working hard to maintain local supply and increase availability for Australian parents and caregivers — sustaining supply to local families is their first priority."

We also contacted the Asia Pacific Infant and Young Child Nutrition Association (APIYCNA), but the organisation declined to comment.

Protecting parents…and profits

Consumer analyst Fiona Dyer said in a GlobalData release: "Australian parents are routinely faced with empty supermarket shelves and the need to visit multiple supermarkets to source their formula of choice. Others are reluctantly forced to change formula brands when they are simply unable to source their preferred options."

As a result, Coles — one of Australia's biggest supermarket chains — has begun placing its infant formula products behind its counters who have a 'genuine need' to provide the necessary nutrition for their children.

The supermarket has said its intention is to prevent daigou shoppers from buying in bulk to sell in China, and to protect Australian parents. One of its rivals, Woolworths, has also taken measures to prevent shortages, in this case by restricting each customer to two cans of infant formula.

However, customer interests are not the sole driver behind these actions.

GlobalData estimated that Coles and Woolworths were responsible for about 89% of infant formula value sales in 2016, making both chains dominant in the area of formula milk distribution. But with online competitors thriving and steadily gaining on their share of the market, physical retailers must do their best to keep up.

Dyer said, "There are several issues at play for Coles and Woolworths. They were comparatively late to online retailing and consequently, consumers are used to buying from other types of online outlets rather than necessarily sticking to the online version of their favourite brick-and-mortar establishments.

"In addition, parents have traditionally been a key consumer group for grocery outlets. Having been enticed into the store to buy formula, they tend to do the rest of their grocery shopping there as well. That is an awful lot of potential lost revenue."

She added that the shortages would not be stopping anytime soon, saying, "As long as babies are still being born in China, there is unlikely to be any reduction in demand from this source, and it will remain an issue within the Australian market for some time to come.

"There is a very real possibility that the seemingly insatiable demand for Australian manufactured formula in China could lead to a seismic shift in the way formula is sold."