Mergers and acquisitions up again in annual Zenith report

The total is 12 more than in 2018 and 41% higher than five years ago. The number has increased every year since a dip in 2013.

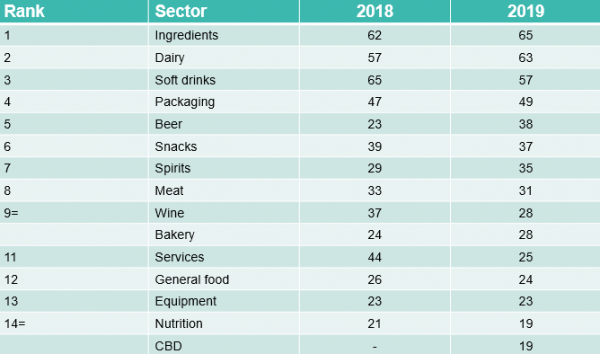

The ingredients sector saw most activity, with 65, with dairy close behind on 63, up from 57 the previous year. Following the rise in plant-based diets and product launches, plant-based (15), dairy-free (14) and meat-free (11) totaled 40, which, combined, would have placed the category in fifth overall.

The top four dairy-related acquisitions came courtesy of some of the biggest hitters in the sector, with top spot being Saputo’s £975m ($1.26bn) takeover of UK company Dairy Crest. Lactalis’ purchase of Itambe in Brazil was second, followed by Mengniu’s purchase of Lion Dairy & Drinks and Yili’s acquisition of Westland.

Lactalis and Saputo both featured twice in the top 10 deals of the year. April was the busiest month, with 10 reported mergers and acquisitions, while May was the quietest, with just one. Overall, 12 of the global deals topped $100m in value.

In terms of countries, the US was the most active in dairy, with 14 entries in the database, followed by 11 in the UK. There were seven listed deals in New Zealand, Germany and France, where five of the seven deals involved Lactalis.

There have already been two deals concluded in 2020, with Mengniu taking a 5% stake in Shanghai Ground Foods, and in the US, Coca-Cola completing the buyout of the remaining 57.5% of the fairlife joint venture from Select Milk Producers.