One area that has seen demand for products increase is in the retail dairy sector, accentuating the need for dynamic supply chains that are able to flex capacity to cover peaks in volumes.

DairyReporter spoke to Alastair Bearman from Chadwicks, a pre-cut lid manufacturer (part of the Clondalkin Group), which saw demand for products into the dairy sector increase by almost 35% during the height of the pandemic. This meant moving to a seven-day working week to maintain the company’s three-week standard lead time, followed by significant investment in an additional printing press to increase annual production capacity for its pre-cut lids into the dairy market by more than 500m additional units.

Bearman said, “It’s been a challenging period, and although there are still uncertainties there are packaging trends and key priorities that seem set to continue. Food-safety and sustainability are two of those trends and innovation is key to addressing them. New technologies are emerging every year and often this means challenging conventional packaging solutions.

“For example, at Chadwicks we now offer a paper-based lid, suitable for dairy products, which a few years ago would not have been considered a viable option. However, the high mechanical strength and superior stiffness afforded by paper-based lids means they offer great resilience to puncture and tearing ensuring the integrity of the product throughout the supply chain. All of the raw material paper used in the lids comes from sustainable sources. They are fully recyclable (where facilities exist) and have a low carbon footprint.”

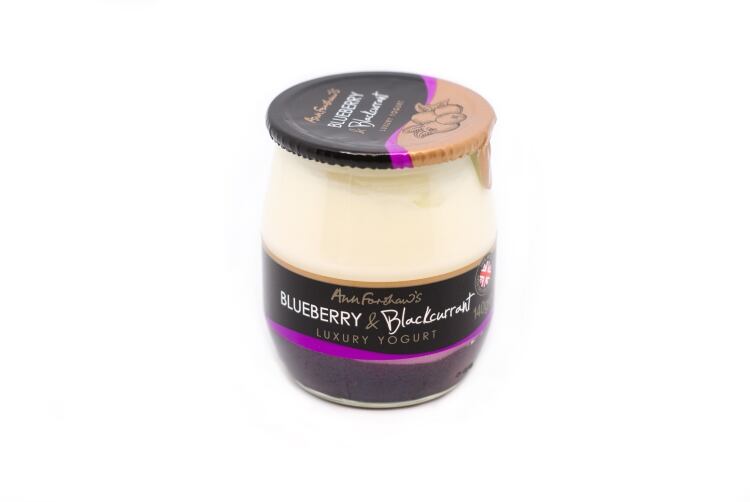

He said that, in some instances, the company is seeing a return to ‘older style’ packaging alternatives, such as aluminum and glass, as people look to reduce plastic consumption, which means suppliers across the packaging supply chain have to adapt and innovate.

“Recently, for example at Chadwicks we refined an aluminum lidding material that seals to glass at the specific request of a dairy customer, although historically sealing pre-cut lids to glass presented many technical difficulties. Through a combination of material expertise and on-site technical support, these problems were overcome. This material use is becoming more widespread as more fully recyclable glass jars are being introduced into the food market.

“Where plastic is still used the developmental emphasis is on recycled plastic and downgauging. Increasingly customers are testing RPET containers. Whereas previously there has been less incentive for brands to use RPET materials, this is now changing due to initiatives such as the tax on plastic packaging containing less than 30% recycled content, expected to come into force in April 2022.”

Bearman said such changes bring challenges to every aspect of the supply chain and strong partnerships between equipment suppliers, raw material suppliers and brand owners are essential.

“At Chadwicks, the move to RPET has meant developing a new heat seal system specifically aimed at providing a comparable seal for lids to RPET pots to ensure the integrity of the product inside, essential for food safety and limiting wastage. Customers do not need to invest in new machinery or even change machinery settings,” Bearman said.

“Looking forward to 2022, there is also growing interest in adding recycled content into packaging which still affords the same functionality and optical properties as standard materials. For Chadwicks this has resulted in the development of recycled content white (30%) and clear (50%) PET lidding.”

Bearman said plastic reduction remains a key driver for the dairy industry, and that while 50 micron PET is the standard industry plastic lidding gauge, there is increased demand for thinner materials.

“At Chadwicks we now have a 36 micron product in white, clear and RPET gauges which is ready for market.

“Whilst many companies are making the switch to more eco-friendly alternatives, Covid-19 has caused increased concern over the health and safety of products. It seems likely that going forward the focus for the dairy packaging sector will continue to be around developing innovative, sustainable alternatives that do not compromise on food safety.”