The cups – which have a thin plastic lining to prevent the yogurt seeping into the packaging – are not widely recyclable right now given the current state of the recycling industry in the US when it comes to composite materials, but still introduce far less plastic into the food supply chain vs regular 100% plastic yogurt cups, he told FoodNavigator-USA.

“You’ve got to start somewhere,” added McGuinness, who said Chobani would continue talking to policymakers and collaborating with partners such as the Sustainable Packaging Coalition to advocate for improvements that expand the recycling infrastructure in the US.

“We’re not going to sit here with our head in the sand and not try to make any change at all, just because the recycling system is broken. Having an industry that's virtually 100% in plastic, relying on petroleum doesn't make sense. So we're going to chip away at it.”

‘It took almost two years to develop’

On a practical level, he said, the initiative had involved a significant amount of work for Chobani, which saw examples of paperboard cups in other markets outside of the US but needed to work closely with its packaging supplier to ensure that the products had an airtight seal and the same shelf-life and so on, which took time.

“We had to make sure that it fit in with our production lines, that the seal worked, that we had the right diameter and the right rigidness for our machines, so that’s basically why it took almost two years to develop,” said McGuinness.

“We also wanted something that would work for of our lines and all of our equipment in both plants [in Idaho and New York], so it's much harder than it seems. It’s also more expensive, but we're betting on the fact that once we scale this thing and the adoption curve goes up, we'll drive the cost down, but we're going to do our part and hopefully inspire others to act and make some positive change.”

The rollout will be accompanied by some consumer communications and the words ‘new paper-based cup’ on the pack, he said, “but we're not doing any big campaign, this is just a small step in the right direction. And we're not done yet, we need to expand it throughout our portfolio and we also want to explore bigger sizes.”

“We all have a role to play in protecting our planet. People have been asking for a paper cup, and we welcome this challenge to start reducing our plastic use, and to spark a conversation about how we can drive change together. While this paper cup is a step in the right direction, it’s just the beginning…”

Hamdi Ulukaya, founder and CEO, Chobani

Image credit: Chobani

Chobani is outpacing the overall yogurt category

While Chobani is now lapping the strong gains it saw in the first few months of the pandemic, it is still generating solid year over year growth and outpacing the overall category, claimed McGuinness (according to SPINS US retail data the category was up +2.2% to $8.43bn in the 52 weeks to July 11).

In the most recent four week and three month data in measured channels, meanwhile, Chobani is growing in the double digits, he said, “while the overall category is up between four and five percent, so we're happy to see that.”

Early indications about new launch Chobani Zero are also encouraging, he said, while recent launches including oatmilk and ready-to-drink coffee are growing strongly.

But he added: “What’s really encouraging is that our base business is growing; we’ve got close to 50% repeat rates on Chobani Flip. So we’re not trying to innovate our way out of a core decline, the fundamentals of the business are great. We’re also seeing a lot of growth in multipacks.

“We’re not immune to supply challenges but I think we’ve weathered them better than most.”

Disrupting the creamers market

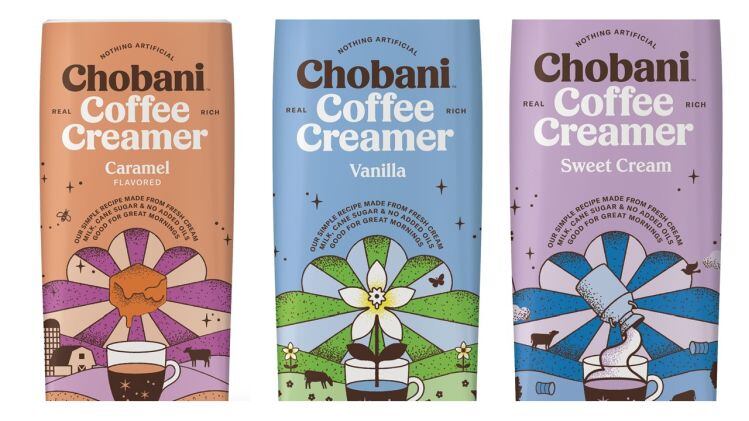

The creamers category - which is dominated by Nestlé (coffee mate) and Danone (International Delight) with products typically made with water, sugar, and vegetable oil (or as McGuinness observes, "creamers with no cream in them") – represents a particularly exciting growth opportunity for Chobani, which launched dairy creamers made from fresh cream, milk, cane sugar and natural flavors in late 2019, said McGuinness.

From a manufacturing perspective, moving into creamers is also a logical move for Chobani, which has a lot of fresh cream in its factories from the yogurt-making process, he added.

“That category is the most similar to yogurt, that 13 years ago [when Chobani started out] was dominated by two legacy CPGs making oil-based creamers with no cream in these giant plastic jugs, and we come in with real dairy ingredients in a Tetra Pak [cartons made from composite materials - paperboard, aluminum, plastic - are often touted as greener than plastic, although many recycling facilities in the US don’t yet handle them].

“Through packaging and well made products, priced right, you can really disrupt categories, and they have exceeded our expectations.”