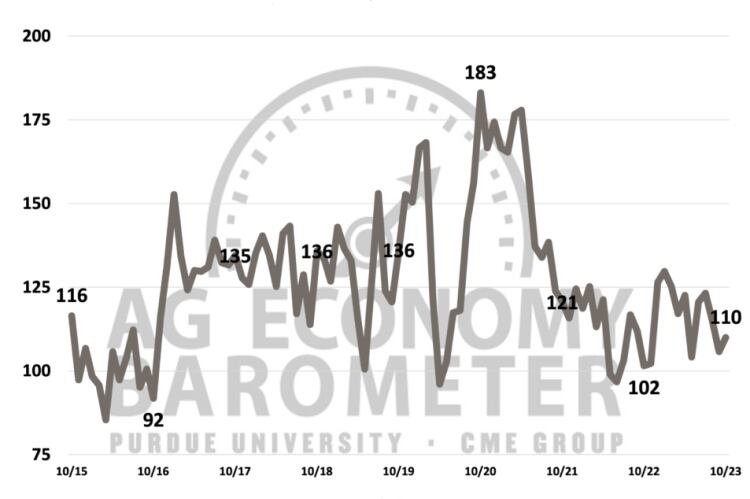

According to the latest Purdue University/CME Group Ag Economy Barometer results, US farmers’ outlook improved as the index rose 3 points higher than February to 114 points.

The Future of Index Expectations rose 5 points in March but the Current Conditions index slipped by 2 points.

The shift in producer expectations for interest rate cuts has strengthened, with 48% of respondent stating they expect a decline in the US prime interest rate over the next 12 months, up from 35% in December.

Fewer producers (32% versus 43% in February) think an increase is on the cards, but a significant share of respondents continue to worry about possible rate hikes. According to the March survey, 20% still consider interest rate increases their primary concern, though this has decreased from 24% in December.

High interest rates dent investment confidence

The Farm Capital Investment Index rose 7 points in March, with the share of producers who think it’s a good time for a large investment rising to 15%, up from 11% at the start of 2024. Key factors for the strengthening of optimism included strong cash flows and higher dealer inventories for farm machinery.

But the overwhelming majority of those surveyed continue to feel hesitant about making large investments due to high costs and interest rates.

The short-term outlook on farmland values also strengthened as the index increased by 9 points on last month, mainly due to perceived non-farm investor demand, inflation expectations and strong cash flows. 24% of producers surveyed said they thought farmland prices would go up due to inflation expectations versus 18% last month; 57% still consider non-farm investor demand the primary reason for their optimism.

Sustainability’s role

More farmers are interested in using farmland for carbon sequestration or solar energy production, according to the latest report.

Almost one in 5 respondents said that they had been approached about capturing or storing carbon on their land, with 12% having had discussions with companies interested in leasing farmland for a solar energy project in the last 6 months; this compares with 10% in February.

Concern about policy changes is also growing louder, with 43% anticipating a more restrictive regulatory landscape for agriculture and 39% expecting taxes that impact agriculture to rise.

Since March 2022 and July 2023, the Fed raised the rate 11 times to tackle inflation. That has in turn increased borrowing costs, including for mortgages, loans and credits.

The Federal Open Market Committee predicted after its December 2023 meeting that it would make three quarter-point cuts by the end of 2024 to lower the federal funds rate to 4.6%.

The full report can be accessed here [PDF].