Dustin Boughton, procurement, at Maxum Foods, said global milk supply is once again gradually growing but this comes as total trade slows.

Adjusting for growth in domestic consumption, the market remains close to balanced, Boughton said, adding the impact of steadily improving milk availability will have varying impact on each commodity group.

The global economy faces plenty of headwinds with the ongoing risks of economic and dairy trade disruptions from a no-deal Brexit; slowing Chinese and South East Asian economies; rising tension in the Middle East, and expectations of a US recession in 2020, according to Boughton.

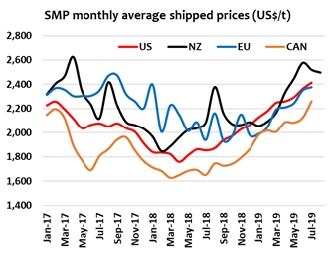

Skim Milk Powder (SMP)

“Firmer SMP prices are expected as surplus EU stocks fall, which will coincide with gradually firming butterfat values as demand improves in Europe and developing markets,” Boughton said.

“Growth in global demand has slowed but key SE Asian markets may have further capacity given past buying trends and landed costs. Chinese demand has been impressive and should remain positive in coming months.”

Whole Milk Powder (WMP)

WMP availability in the next year will be virtually unchanged from the past year, Boughton said, taking account of a small growth in NZ output, improved production in Latam, and similar output in the EU. He also noted that global WMP trade declined 16% YOY in July, the largest decline since June 2018. This fall brought growth in the last quarter 4.5% below the comparable.

Butter

“Fat prices may have bottomed in Europe, although product remains in good supply, ensuring price gains may be gradual,” Boughton said.

“Trade with the developing world continued to be poor at rising prices, with substantial declines in China & HK. NZ trade, which has considerable exposure to developing markets, has consistently declined since the end of Q1-19. A recovery in demand from developing regions is critical to any recovery.”

Cheese

World cheese prices have diverged, with the EU cheapest by far in Q3-2019, according to Boughton.

“While improving fat and protein values should eventually support higher EU cheese prices, cheaper EU prices offered to export markets in the short-term may further weaken Oceania prices. US prices surged with short-term shortages in cheddar supplies but are expected to weaken in coming months.”

Whey

Following YOY declines in every single month since December 2018, whey products trade lifted 2.5% YOY to 137,670t, Boughton said. He added the decline in global trade in whey products since December 2018 was 6.8%, mostly the result of weaker shipments into China, due to the culling of their pig herd to address swine fever and the imposition of punitive tariffs.