Parmigiano Reggiano enjoyed a 7.9% increase in sales in Italy and a 10.7% increase abroad, including a 21.8% increase in the UK. Production also increased by 4.9% and prices are back to profitability.

The 3.94m wheels of cheese (around 160,000 tons) produced in 2020 is the most in the history of Parmigiano Reggiano. The product achieved a turnover of €2.35bn ($2.78bn).

Parmigiano Reggiano producers said they also enjoyed a very good 2020 as far as prices are concerned. In the first quarter, the price of 12-month-old Parmigiano Reggiano (based on the average price of 12-month Parmigiano Reggiano from producing dairy, source: bulletins from Borsa Comprensoriale Parma) was €7.55/kg ($8.92/kg) and rose above €10/kg ($11.82/kg) by the end of the year. The average annual price (€8.56/$10.11/kg) was below the 2019 price, but the increase in the second half of the year led to a recovery of margins.

The Parmigiano Reggiano market is becoming increasingly international. In Italy, which accounts for 56% of the market, a 7.9% increase in sales volume was recorded, with large retail remaining the top distribution channel (61%), followed by normal trade (13%), retail (12%), and the food industry (4%).

Accounting for only 2%, the HORECA channel is open to margins for improvement as it experienced a drastic fall caused by restaurant closures during the pandemic. The remaining 7% is distributed in other sales channels.

The export share is 44%, with a volume growth of 10.7% year-on-year. Accounting for 20% of overall Parmigiano Reggiano exports, the US is the leading export market, followed by France (19%), Germany (18%), the UK (13%), and Canada (5%).

Of these, the best performances were recorded in the UK (up 21.8%), Germany (up 14.8%), and France (up 4.2%). Growth was also recorded in the US (1.9%) and Canada (36.8%), as well as in newer markets such as Australia (up by 85.4%), the Gulf region (up by 62.3%), and China (up by 8%).

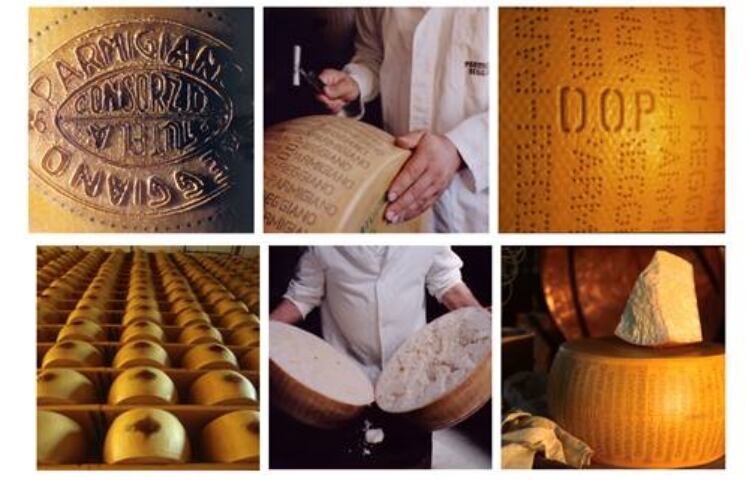

Nicola Bertinelli, president of the Parmigiano Reggiano Consortium, said, “Despite the difficulties which emerged from the COVID-192 pandemic, Parmigiano Reggiano ended 2020 on a positive note, which has rewarded the PDO product’s reputation and unbeatable quality. Consumers forced to give up out-of-home meals for several months have clearly shown their preference for Parmigiano Reggiano across all of its key markets. We are therefore ready to deal with a challenging 2021, as the Parmigiano Reggiano brand is ready to become a truly global brand.”

While the UK showed a 21.8% rise in imports, in 2021 the country is no longer a part of the EU.

Bertinelli told DairyReporter, “The UK is the fourth foreign market for Parmigiano Reggiano with 7,863 tons of imported product in 2020.

“Following Brexit, there will be no significant changes in terms of brand protection because Parmigiano Reggiano is a registered trademark in the UK and enjoys legal protection which also extends to the term parmesan. But the concern is strong for several reasons: from the risk of convergence of possible new duties to the reflections of a probable post-Covid economic crisis that would impact on the spending power of overseas families.

“Another potential risk associated with Brexit is that an unfavorable legislation to Italian agri-food exports is implemented in the UK, such as the 'traffic light' nutrition label that is spreading in most UK supermarkets and unfairly rejects most of the Made in Italy products with PDO status.

“Then there is the risk of new duties, a scenario that the consortia will have to manage in coordination with the EU. It should also be borne in mind that the costs of the Consortium for the protection of supervision in the UK could increase, as leaving the EU, the ex-officio protection rule may no longer be valid: the protection and supervision actions will therefore be completely charged to the Consortia.”